Analysts are attempting to predict how Grayscale Investments LLC’s conversion of its Bitcoin trust into an exchange-traded fund will proceed now that the Securities and Exchange Commission has decided not to appeal a decision that allows the conversion.

The cryptocurrency asset manager won a battle in federal court earlier this year to establish the first US exchange-traded fund (ETF) that will invest straight in the biggest digital currency with its Grayscale Bitcoin Trust (ticker GBTC). The SEC had until this Friday to file an appeal of the decision. An individual with knowledge of the case, who wished to remain anonymous when discussing the ongoing issue, stated that the agency does not intend to file any more appeals in the case.

James Seyffart, an analyst at Bloomberg Intelligence, predicts that communication between Grayscale and the SEC will likely open up. “Next week, we’ll receive additional details and be aware of the next steps,” he stated.

Although he believes it is extremely unlikely, Seyffart stated that the regulator has the option to seek an appeal with the Supreme Court.

A request for comment regarding the agency’s intentions for spot Bitcoin ETFs was not answered by the SEC.

According to Grayscale, holders of GBTC might gain billions of dollars if it were converted into an ETF. After a ten-year fight, the industry was excited that a Bitcoin ETF could finally be available in the US thanks to its court victory, which was regarded as historic for the sector. In the past, the SEC had been reluctant to approve.

In the past, the SEC had been reluctant to approve. However, a number of businesses are actively working to develop such a product, including Invesco and BlackRock Inc.

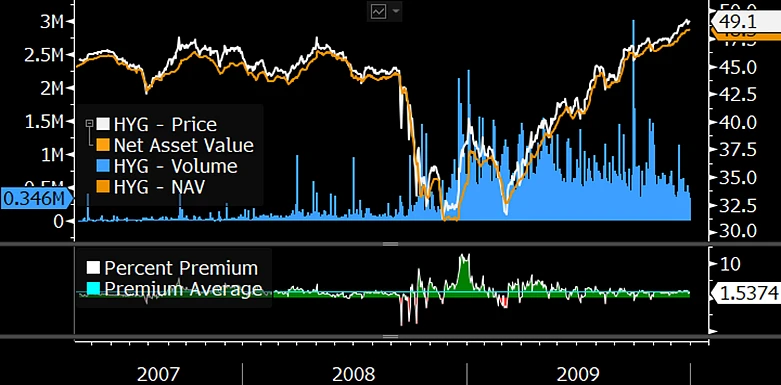

Shares of GBTC increased faster than Bitcoin itself after the Grayscale verdict in August, and the trust’s margin of error compared to its underlying assets shrank dramatically. According to figures collated by Bloomberg, the margin narrowed to less than 20% from around 45% earlier in the year. Several well-known investors, such as Boaz Weinstein and Cathie Wood, seem to have been well-positioned for the narrowing as they bought GBTC shares at the height of the company’s recent turmoil.

The ETF approval process has remained unclear to industry observers due to uncertainty about how the SEC would handle the asset-manager’s procedures and the multiple other pending applications. However, progress on the grayscale conversion front has brought additional clarity to this process. One important unanswered question is whether the regulator will permit the simultaneous launch of several Bitcoin ETFs.

A recent amendment to an application from ARK and 21Shares, according to Bloomberg Intelligence analysts, indicates a “constructive conversation” with regulators, which usually occurs only when an ETF is on the verge of approval. By roughly January 10, there is a 90% likelihood of receiving SEC approval.