David Iben explained it best when he stated, “We don’t care about volatility as a risk.” Our main concern is preventing a permanent loss of capital. Given that debt is frequently implicated in business failures, it makes sense to take a close look at a company’s balance sheet when assessing its level of risk. It is evident that debt is used by Kimberly-Clark Corporation (NYSE:KMB) in its operations. But should the company’s use of debt worry shareholders?

Generally speaking, a company’s inability to pay off debt—either through capital raising or its own cash flow—is the first sign that it poses a serious issue. The process of ‘creative destruction’ in which financiers ruthlessly liquidate failing enterprises is an inherent feature of capitalism. But a more common (though still expensive) scenario is when a business has to issue shares at deeply discounted prices, therefore permanently diluting shareholders, in order to support its balance sheet. Having said that, the most typical scenario involves a business that manages its debt fairly effectively and for its own benefit. Examining a company’s cash and debt combined is the first step in determining how much debt it uses.

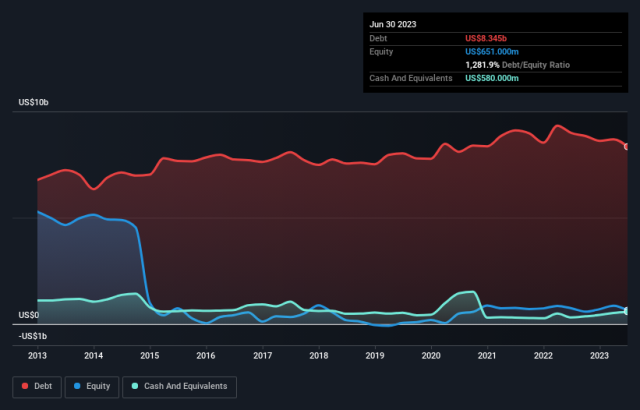

As you can see by clicking on the figure below, Kimberly-Clark’s debt decreased from US$8.99b over a year to US$8.35b at the end of June 2023. But it also had US$580.0 million in cash, meaning its net debt was only US$7.77 billion.

Kimberly-Clark’s most current balance sheet shows that the company had US$10.1b in outstanding debt after a year and US$6.60b in liabilities that were due within a year. However, it had US$2.36 billion in receivables that were past due within a year and US$580.0 million in cash on hand. Therefore, its liabilities are $13.8 billion greater than the whole of its cash and (near-term) receivables.

With a market valuation of US$40.7 billion, Kimberly-Clark is quite likely able to raise funds if necessary to improve its balance sheet. However, we should be alert for any signs that the debt is posing an excessive risk.

We compute net debt divided by profits before interest, tax, depreciation, and amortisation (EBITDA) and earnings before interest and tax (EBIT) divided by interest expense (its interest cover) to determine how much debt a company has in relation to its earnings. In this manner, we take into account both the total amount of debt and the interest rates paid on it.

Ultimately, a business cannot record earnings in order to pay off debt; only physical currency can. Thus, we constantly assess the percentage of EBIT that is converted into free cash flow. Over the previous three years, Kimberly-Clark generated strong free cash flow, which was roughly in line with our expectations at 64% of its EBIT. When it wants to, it can pay off its debt thanks to this real cash.

Fortunately, Kimberly-Clark appears to be in control of its debt based on its impressive interest cover. The good news doesn’t stop there, since the conversion of EBIT to free cash flow is also rather encouraging. When we consider all of the previously listed aspects combined, we conclude that Kimberly-Clark can manage its debt rather easily. Although this leverage has the potential to increase shareholder returns, it also increases the danger of loss, so it’s important to keep an eye on the balance sheet. Without a question, the balance sheet provides the most information concerning debt. However, in the end, risks that are not included in the balance sheet might affect any business.