The shares of Cal-Maine Foods (NASDAQ:CALM) has increased 3.9% in the last month. We made the decision to examine the company’s fundamentals in order to see whether they may be affecting the market, as the market often pays for a company’s long-term financial health. In particular, we made the decision to examine the ROE of Cal-Maine Foods in this piece.

One important metric for evaluating how well a company’s management is using its money is return on equity, or ROE. ROE, to put it briefly, displays the profit that each dollar makes in relation to the investments made by shareholders.

As of now, we know that ROE is a gauge of a business’s profitability. The potential for earnings growth of a firm may then be evaluated based on how much of these profits it reinvests, or “retains,” and how well it does so. When everything else is equal, companies with strong profit retention and return on equity often expand faster than companies without these characteristics.

To start with, we are pleased with Cal-Maine Foods’ strong return on equity. Furthermore, the ROE of the firm surpasses the industry average of 13%, which is really impressive. Therefore, it is not really unexpected that Cal-Maine Foods has seen a significant 57% increase in net income during the last five years.

It’s encouraging to note that Cal-Maine Foods’ growth is far higher than the industry average increase of 12% during the same time, as we discovered when we compared its net income growth to that of the industry.

A company’s worth is largely determined by the rate at which its earnings are growing. An investor should be aware of whether the market has factored in the anticipated rise (or drop) in the company’s earnings. They will be able to determine if the stock is going for clear blue waters or marshy ones by doing this. Check out this comparison of Cal-Maine Foods’ price-to-earnings ratio to its industry if you’re unsure about the company’s valuation.

With a three-year median payout ratio of 33%, or 67% of its revenue retained, Cal-Maine Foods’ payout ratio is neither excessively high nor unduly low. Based on its remarkable growth, as we previously reviewed, it appears like Cal-Maine Foods is reinvesting its profits wisely and that the dividend is fully covered.

In addition, Cal-Maine Foods has been distributing dividends for a minimum of 10 years. This demonstrates the business’s dedication to paying its shareholders a portion of its profits.

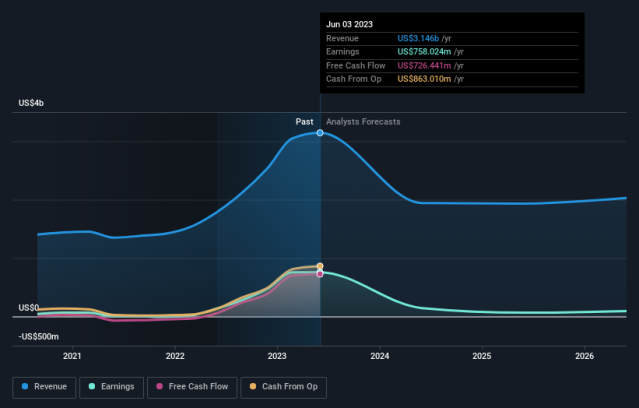

All things considered, we are quite pleased with Cal-Maine Foods’ success. In particular, we like that the business is reinvesting a sizable portion of its earnings at a strong rate of return. Naturally, this has resulted in a significant increase in the company’s earnings. That being said, the company’s profits are anticipated to decline in the future based on the most recent projections from industry analysts. To learn more about the most recent projections made by analysts for the firm,