It is simple to ignore Ashland (NYSE:ASH), given that its stock price has down 8.6% during the last three months. The long-term financial performance of a corporation, which in this case appear to be respectable, is typically what determines stock prices. In this essay, we chose to focus specifically on Ashland’s ROE.

Return on equity, also known as ROE, is a helpful metric for determining how successfully a business can create returns on the investments it has received from its shareholders. Simply said, ROE displays the profit that each dollar makes relative to shareholder investments.

Net profit (from ongoing operations) minus shareholders’ equity equals return on equity.

As a result, using the calculation above, the ROE for Ashland is:

Based on the trailing twelve months to June 2023, 7.5% is US$236m to US$3.1b.

The amount earned post-tax over the previous twelve months is the “return.” This means that the company made $0.07 in profit for every $1 in equity owned by shareholders.

So far, we’ve learnt that ROE gauges a business’s profitability generation efficiency. We may then determine a company’s potential for earnings growth based on how well and how much of these profits it reinvests, or “retains”. In general, firms with a high return on equity and profit retention expand more quickly than those without these characteristics, all else being equal.

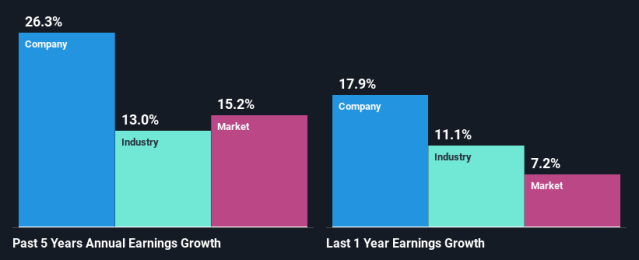

According to appearances, Ashland’s ROE is not particularly noteworthy. The company’s ROE makes us feel even less enthused when compared to the average industry ROE of 14%. Despite this, Ashland was still able to significantly increase its net income during the last five years, at a pace of 37%. Therefore, there may be more factors having a favourable impact on the company’s earnings growth. For instance, the business is managed well or has a low payout ratio.

As a further step, we compared Ashland’s net income growth to that of the sector, and gratifyingly, we discovered that the company’s growth is greater than the sector’s average growth rate of 14%.

Growth in earnings is a key component of stock pricing. An investor should be aware of whether the market has already factored in the anticipated growth (or drop) in the company’s earnings. They can determine whether the stock’s future appears good or concerning by doing this. The P/E ratio, which establishes the price the market is ready to pay for a stock based on its earnings prospects, is one reliable predictor of anticipated earnings growth. So, you might want to see if Ashland is trading at a high or low P/E compared to other companies in its sector.

The three-year median payout ratio for Ashland is a rather low 39%, which means the business keeps 61% of its earnings. In order to see strong growth in its earnings (described above) and pay a dividend that is fully covered, Ashland must be reinvesting its money effectively.

Furthermore, Ashland has a history of paying dividends for at least ten years, which suggests that it is committed to continuing to distribute its profits to shareholders. According to current expert projections, the company’s payout ratio should decrease to 24% during the following three years. The decrease in the payout ratio accounts for the company’s ROE rising to 11% over the same time period.

Overall, we believe that Ashland has a number of merits to take into account. The corporation has reported remarkable earnings growth despite the low rate of return due to significant business reinvestment. Having said that, the company’s earnings growth is anticipated to slow down, according to the most recent industry expert projections. To learn more about the most recent analyst forecasts for the business,