A report indicating that the Fed’s preferred measure of underlying inflation barely increased in November supported the growing narrative that central bankers have successfully broken the back of price pressures and will aggressively ease monetary policy in 2024. This report caused rates to fluctuate on Friday ahead of an early market close at 2 p.m. New York.

Money managers have been buying Treasuries in large quantities in recent weeks due to this ethos; Citigroup Inc. has described the current situation as “at extremes.” Since August 2019, asset managers have placed the largest wager on ultra-long bond futures, which correspond to the 30-year maturity, according to data from the Commodity Futures Trading Commission as of December 19.

Swaps contracts linked to Fed meetings indicate a greater than 90% chance that the US Federal Reserve would reduce its target rate range from its current 5.25% to 5.5% in March. Traders are projecting rate reductions of around 160 basis points through 2024, which is more than twice as much as what Fed officials said in their most recent round of quarterly projections earlier this month.

Even if we believe that a Q1 shift down in the target range is too soon, the weakest rate of year-over-year core inflation in over three years solidifies the next macro question on the timing of the cut from the Fed, according to a note from BMO Capital Markets strategist Benjamin Jeffery.

Even while orders for durable goods exceeded forecasts in a different data, which encouraged some position squaring, it wasn’t enough to significantly change rate expectations.

The yield on the ten-year Treasury finished down less than one basis point. The rate, which is currently at around 3.90%, has decreased by more than a percentage point after reaching a 16-year high of 5.02% in October. The two-year yield hit a cycle high of 5.26% in October, but it only slightly decreased on Friday to hover at 4.32%.

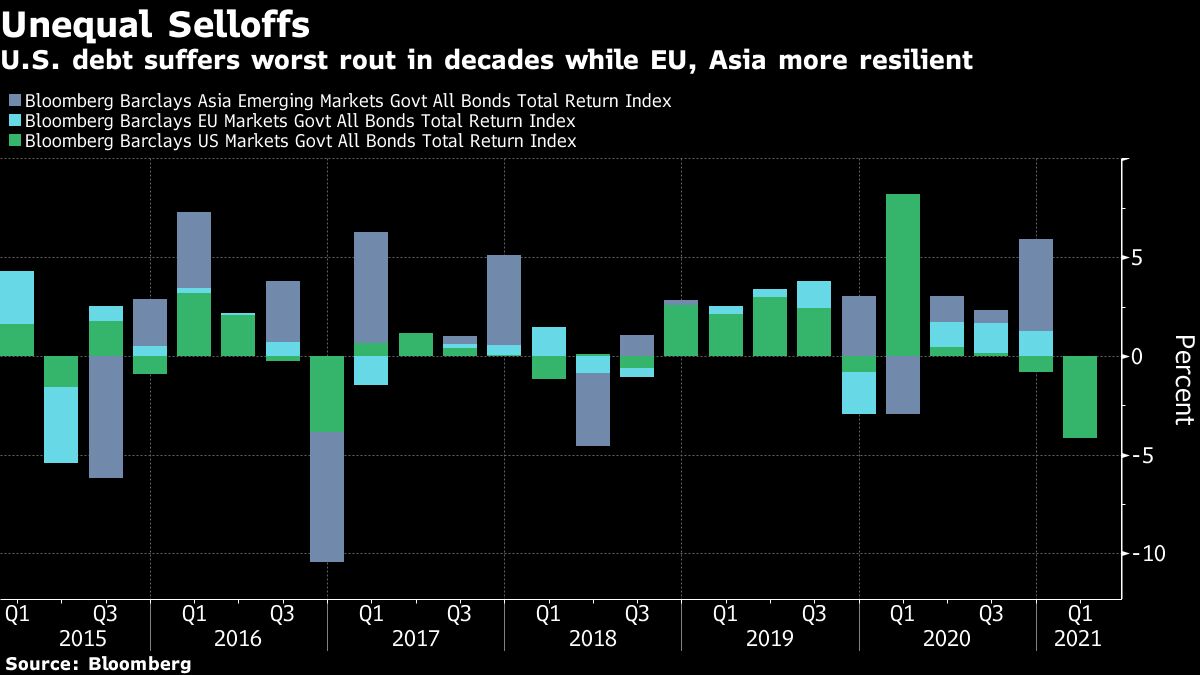

According to Bloomberg index data, Treasuries saw an unexpected reversal this year, rising 3.6% through December 22 from just a few months earlier when it appeared like US government debt would experience a historic third year of annual losses. US Treasury bonds saw losses of 2.3% in 2021 and 12.5% in 2018.

A $155 billion wave of new bond and fixed-rate note sales is scheduled for next week, though, so any additional decrease in rates by year-end could be limited. On Tuesday, the US Treasury will offer $57 billion in 2-year notes; on Wednesday, it will sell $58 billion in 5-year notes; and on Thursday, it will sell $40 billion in 7-year debt.

According to Thomas di Galoma, co-head of global rates trading at BTIG, “illiquid holiday markets and some selling pressure ahead of next week’s auctions” held yields in control on Friday.

The US Federal Reserve’s goal of slowing the rate of economic growth may be thwarted by robust income statistics included in Friday’s data release, even though the Fed welcomes the ebbing of inflation.

That might end the bond market’s recent upward trend and provide dangers going into the new year.

In the past, traders have frequently been caught off guard by pricing in an abrupt and abrupt change to monetary easing. Also, as Citi pointed out,