The fact is that you will eventually own some losing stocks if you invest for a long enough period of time. However, the previous three years have not been kind to SunPower Corporation (NASDAQ:SPWR)’s long-term stockholders. Because of the 69% share price crash at that time, they may be experiencing mental distress. Also struggling are more recent purchasers, whose numbers have dropped by 68% in the past year. The share price has dropped by 55% in the previous three months, signalling an acceleration of the declines.

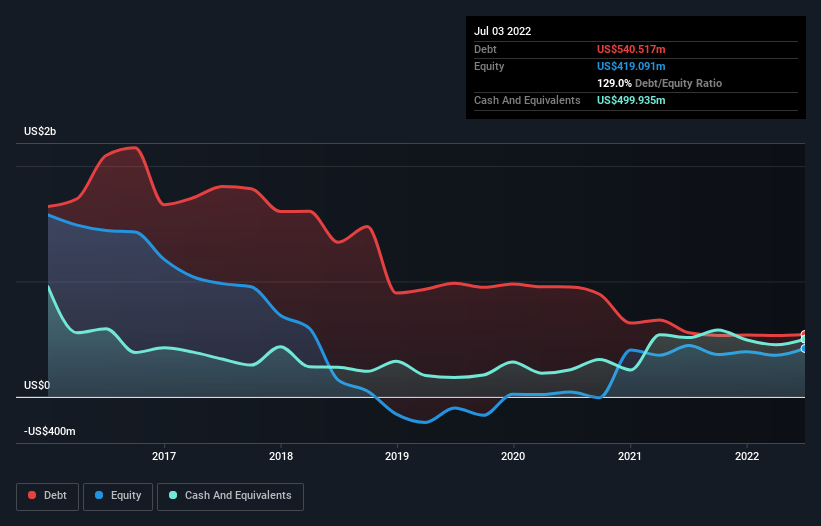

Let’s examine whether there is a discrepancy between the share price and the fundamentals. Based on the previous week, investor opinion towards SunPower has not been favourable.

As it happens, if you invest for a long enough period of time, you will eventually own some losing stocks. However, during the past three years, SunPower Corporation (NASDAQ:SPWR) long-term stockholders have had an unlucky run. They may thus be experiencing mental distress due to the 69% share price decline throughout that period. Additionally, with a 68% decline in the past year, more recent buyers are also struggling. The stock price has dropped by 55% in the previous three months as the declines have increased recently.

Let’s analyse whether there is a discrepancy between the share price and the fundamentals, as investor sentiment towards SunPower has not been good over the last week.

Warren Buffett explained in his essay The Superinvestors of Graham-and-Doddsville how stock prices don’t always accurately reflect a company’s worth. Analysing how a company’s share price and profits per share (EPS) interact is one technique to see how market sentiment has evolved over time.

Over the course of five years, SunPower’s share price increased from a loss to a profit. Usually, this would mean an increase in the share price. Because of this, it becomes sense to look at several additional variables in addition to the share price.

In fact, during the last three years, revenue has increased by 22%, suggesting that revenue is not the primary factor driving the share price decline. This is only a cursory examination, but given that stocks can occasionally fall unfairly, it would be worthwhile to look into SunPower more thoroughly. This could provide a chance.

SunPower investors had a difficult year, losing 68% of their money overall despite a 13% rise in the market. Even solid companies occasionally suffer a decline in price, but before becoming overly excited, we want to observe improvements in a company’s basic data. Longer-term investors would not be as angry since over a five-year period, they would have made 6% annually. Checking the basic data for indications of a long-term growth tendency may be worthwhile because it’s possible that the current sell-off represents an opportunity. Following the performance of share prices over an extended period of time is always intriguing. To further comprehend SunPower, however,