Markets were rattled on Friday by two strong economic reports, and equities rose on expectations that the US will be able to avoid a recession. On the other hand, as a result of bond dealers’ forced reduction of their bets on rate cuts in 2024, rates skyrocketed.

The general consensus on Wall Street is that although a strong economy helps investors feel less fearful of a catastrophic landing, it also means the Fed may need to keep interest rates higher for an extended period of time. In terms of Treasuries, that indicates a reversal of the huge dovish trade that suggested a March Fed turn. In terms of stocks, employment and consumer tenacity are encouraging when it comes to Corporate America.

According to Chris Zaccarelli of Independent Advisor Alliance, “the economy continues to show signs of strength just when you think it is finally softening.” “We are still optimistic about the market because we are optimistic about the economy.”

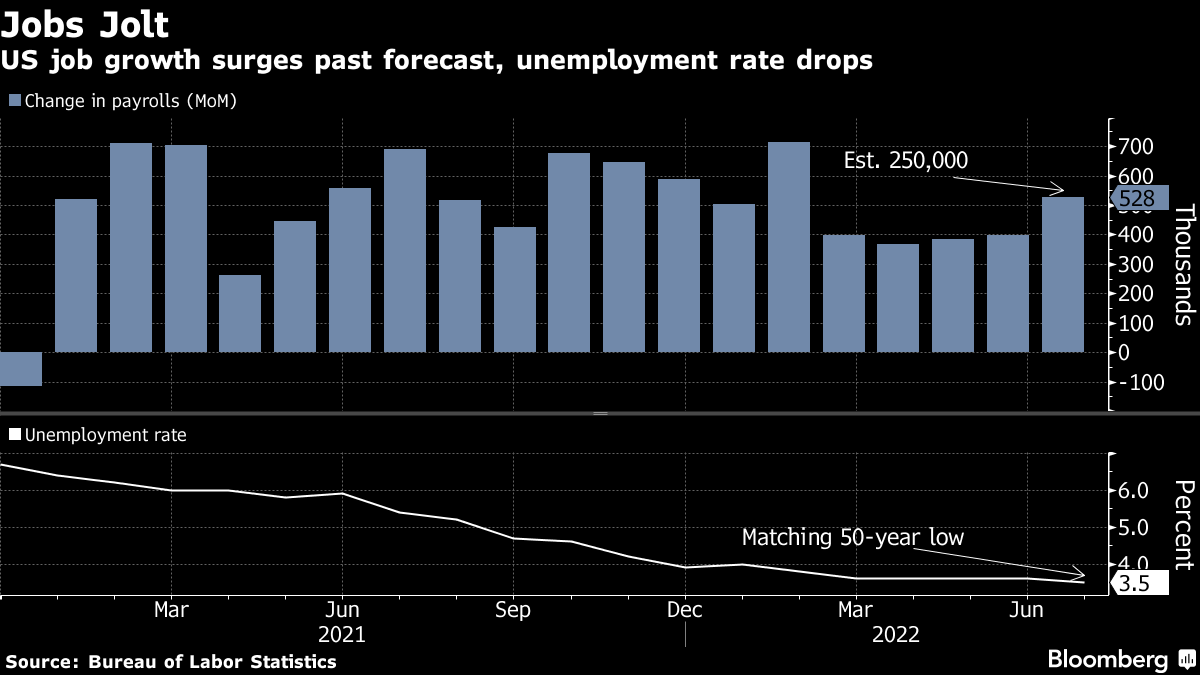

The labor-market slump was highlighted by a number of data points, but Friday’s jobs report revealed an unexpected improvement. Last month, there was a 199,000 rise in nonfarm payrolls, a 3.7% decrease in the unemployment rate, and monthly wage growth that exceeded forecasts. In the meantime, US consumer confidence dramatically improved in early December, above all projections, as consumers reduced their estimates for inflation in the coming year by the largest amount in 22 years.

The S&P 500 has increased for six weeks running, which is its longest winning streak since November 2019. The VIX, Wall Street’s “fear gauge,” recovered to its pre-pandemic levels. US two-year rates reached 4.72%, up 13 basis points. Prior to the economic statistics, there was a probability of over 50% for a rate decrease in March; currently, swap contracts indicate a 40% chance.

The robust employment report may serve as a “heat check for Wall Street,” according to Callie Cox of eToro, following the market’s sharp rally following the rate-cut move. She said hopes had been raised a bit too high.

“The US economy is still doing very well,” Titan Asset Management’s John Leiper stated. “Bond rates are rising, reversing the sharp drop in US Treasury yields that we witnessed last month and which already appeared a little exaggerated. The trend of going longer term is back, with markets pricing in rate reductions for the upcoming year.

Investors now believe that the Fed has finished rising interest rates, and bets that rate cuts of at least 125 basis points were in store for the next 12 months have increased as a result of softening inflation and job statistics over the previous month. The bets were reduced by traders to around 110 basis points of easing.

“Those who claim there is a recession should have their heads examined,” Renaissance Macro Research’s Neil Dutta stated.

With the US consumer price index and retail sales data, a condensed schedule of Treasury auctions, and the Fed’s last meeting of the year on the agenda, traders are gearing up for another hectic week.

On Wednesday, it’s generally anticipated that Fed policymakers will maintain borrowing costs at their highest point in 20 years. Chair Jerome Powell has consistently resisted calls for policymakers to decrease interest rates early in the upcoming year, emphasising that they will go gradually and still have the flexibility to boost rates.

Better-than-expected data releases have stumped the Fed, according to Quincy Krosby of LPL Financial. “The Fed is expected to stay on hold as long as inflation keeps trending downward. However, if the data from today indicates that consumer spending will continue, the Fed may need to send out a much more hawkish message and signal that they are still unable to declare victory in their fight against inflation.

Lawrence Summers, the former Treasury Secretary, stated that the Fed should wait to start cutting interest rates until there is clear indication that either the economy is about to enter a recession or that inflation is once again under control.

According to Brian Rose of UBS, the Fed may refrain from coming off as “overly dovish” because the market is already pricing in a number of rate cuts in 2024.

According to Ronald Temple of Lazard, the Fed is expected to maintain its tight policy until mid-2024, at which point inflation should have decreased enough to justify a mild relaxation cycle.

Investors should welcome the news because it indicates the Fed is providing a “goldilocks” scenario of lower inflation without recession, which is the greatest result for risk assets, he said, even though labour market strength means fewer rate reduction.

According to strategists at JPMorgan Chase & Co., a key indicator of stock-market anxiety will rise in 2024 after falling to its lowest point since before the pandemic struck. The degree of the increase will depend on how strong the economy is.

The magnitude of the increase will depend on the timing and intensity of an eventual recession, as well as possible bigger swings that might prevent selling of short-term volatility. The Cboe Volatility Index is expected to “generally trade higher in 2024 than in 2023,”

Michael Hartnett of Bank of America Corp. predicts that the first quarter of 2024 would see a decline in stock markets as a rise in bonds would indicate faltering economic growth.

According to Hartnett, the story would shift from “lower yields = higher stocks” to “lower yields = lower stocks.”

Additionally, according to Hartnett, sentiment indicators are no longer consistent with additional advances in risky assets. In the week ending December 6, BofA’s unique bull-and-bear signal increased to 3.8 from 2.7, marking the largest weekly increase since February 2012. Generally speaking, a reading of less than two indicates a contrarian buy recommendation.

According to BofA, which cited statistics from EPFR Global, money-market funds saw their biggest inflows since March, while US stocks saw inflows for an eighth consecutive week.

The chief investment officer and head of investments at Citi Global Wealth, David Bailin, believes that stocks are primed for more gains in 2024 as the economy continues to grow, inflation trends downward, and earnings start to rise. This will increase the opportunity cost for investors who are still holding onto their cash and staying on the sidelines.

He remarked, “I don’t know what investors are waiting for.” “If the US economy is going to remain robust and money-market rates will eventually decline, then why aren’t more people investing in basic 60/40 portfolios?”

One of Apple Inc.’s most important product lines will be reorganised with the resignation of the executive in charge of designing the company’s iPhone and wristwatch products.

For an estimated $5 billion, Honeywell International Inc. has agreed to purchase Carrier Global Corp.’s security division. This is the largest acquisition for the jet engine and gas detector manufacturer since 2015.

Starbucks Corp. announced that it has made contact with the union that represents hundreds of its locations in an attempt to resolve a standoff that has damaged the company’s rapport with some of its front-line staff.