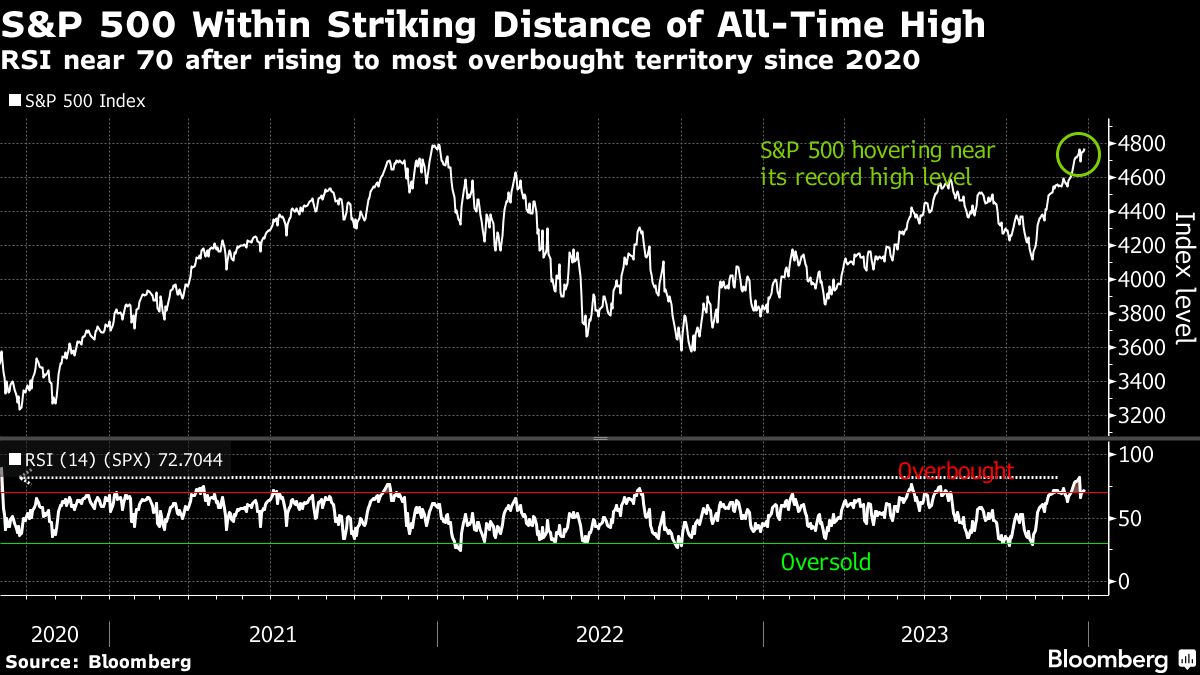

The stock market has not moved much in the last days of the year. A Wall Street proverb that states “never short a dull market” was invoked by some traders, although worries have emerged due to overbought levels and cautions regarding too dovish Fed bets. The Nasdaq 100 and the Dow Jones Industrial Average just reached an all-time high, and the S&P 500 faltered close to it as well. This has sparked discussion about whether investors should be happy or concerned.

“What has the S&P 500 done after it has climbed out of its hole is perhaps the most important question,” Ned Davis Research’s Ed Clissold stated. Was the market overbought and in need of a correction after the run to new highs? Or did something burst out?

According to Clissold, the S&P 500 has surpassed its long-term average one, three, six, and twelve months later. The one-month returns are not nearly as robust, which in certain circumstances points to a transient overbought situation. After a year, there has been a median increase of 13.4%, or 13 out of 14 times, in the gauge.

Less than 0.5% separated the S&P 500 from its all-time high of 4,796.56. Bond rates fell as a result of strong demand for a $58 billion offering of five-year notes. That came after a surprise successful two-year auction on Tuesday, which attracted bidders looking to lock in higher rates ahead of the Fed’s policy easing.

As early as March, traders had increased their bets on rate reduction, according to Fed swaps pricing. Since officials revised their predictions this month to reflect their expectation to lower rates more quickly than previously anticipated, that opinion has gained traction.

Jose Torres of Interactive Brokers believes that there is too much hope for the Fed to win the fight on inflation since the data in the upcoming months will probably convince policymakers to postpone rate decreases until May at the latest.

Tom Essaye, a former Merrill Lynch trader and creator of The Sevens Report newsletter, stated that “markets have priced in the dovish pivot and stocks never discount the same news twice.” “For the S&P 500 to reach new all-time highs at the beginning of 2024, the markets will need to see new, positive catalysts.”

According to CFRA’s Sam Stovall, 90% of S&P 500 companies are presently trading above their 50-day averages, suggesting yet another indication of potential overconfidence.

“History reminds us that the S&P 500 typically enjoyed a post-recovery gain of 10% in four months before stumbling into another decline of 5% or more — none of which became a bear market in 2022, even though there may be a pause after recovering all that was lost in that bear market.”

The Goldman Sachs US Financial Conditions Index has shifted from quick tightening to rapid relaxing, according to Bespoke Investment Group. The gauge is at its lowest point since August 2022 right now. Bespoke pointed out that strong periods for large- and small-cap stocks have historically followed rapid easing.

The chief investment officer of Navellier & Associates, Louis Navellier, stated that “asset prices continue to march slightly higher towards year-end.” “Delayed profit-taking may occur in January, but there is still plenty of money on the sidelines to take advantage of any opportunities that may arise.”

The soft-landing scenario that investors anticipate for the upcoming year suggests more gains in US stocks for many traders. However, it also lessens the likelihood that the dominant technological companies of 2023 will have another period of extraordinary outperformance.

The artificial intelligence boom helped to the group’s growth, which saw it rise over 100% through mid-July, while the S&P 500 saw a 20% increase. However, the gains of the IT titans became less pronounced as investor confidence in the economy increased following the Fed’s interest-rate hike in July, which they now believe to be the final of this cycle.

“Look to trim and rebalance back to where you were at the start of 2023 if you were fortunate enough to own the ‘Magnificent 7’ in 2023,” advised Michael Landsberg of Landsberg Bennett Private Wealth Management. “Trimming after big runs makes sense, but we still like most of those names.”

In addition, Landsberg stated that he believes there will be a significant increase in the number of people participating in the stock market by 2024 “because it is unhealthy for a small number of heavily owned stocks to drive overall market performance.”

In business news, Apple Inc. obtained a court order to temporarily halt the US government’s prohibition on selling its newest smartwatches. The New York Times Co. filed lawsuits against OpenAI Inc. and Microsoft Corp. for using information to support the creation of artificial intelligence services.

Hapag-Lloyd AG, a major shipping company, declared that it will continue to keep its ships out of the Red Sea even after the US-led taskforce was established to guard the vital commerce route against terrorist threats. Amid light holiday trade, oil pulled down from its highest level in over a month as important technical indicators showed signs of weakening.

In other news, Bitcoin bounced back on fresh rumours that the US securities regulator is almost certain to approve an exchange-traded fund that will invest straight in the largest token.