Powell mentioned policy-sensitive two-year rates this week, and both those yields and those on longer-dated bonds fell precipitously after his comments. This has lessened the impact of the most recent devastating Treasury sell-off that has shook the world economy, driving down asset values, driving up real estate costs, and driving up operating expenses for corporations in the US and elsewhere.

Powell surmised that high Treasury rates may alternatively enable the central bank to maintain tight monetary conditions in order to wring out the inflationary excesses of current business cycle, even while the Fed maintained the possibility of taking further policy action in response to robust economic growth.

The issue at hand is that Fed policymakers run the risk of being in a no-win situation if the financial environment significantly improves on expectations that the US central bank has finished its aggressive tightening campaign, which are likely fueled by Powell.

Former New York Fed President Bill Dudley stated on Bloomberg Television that “one problem, I think, the chairman has at this point is by talking to markets in a supportive way, stocks rally, bond yields fall — that’s loosening financial conditions.” “That’s taking away some of the constraint that was providing some motivation to refrain from tightening monetary policy even more.”

The Treasury disclosed intentions to sell fewer assets than anticipated at its quarterly refunding auctions next week, and a measure of US industrial activity also came in below forecasts. As a result, US rates were already beginning to decline ahead of the Fed announcement.

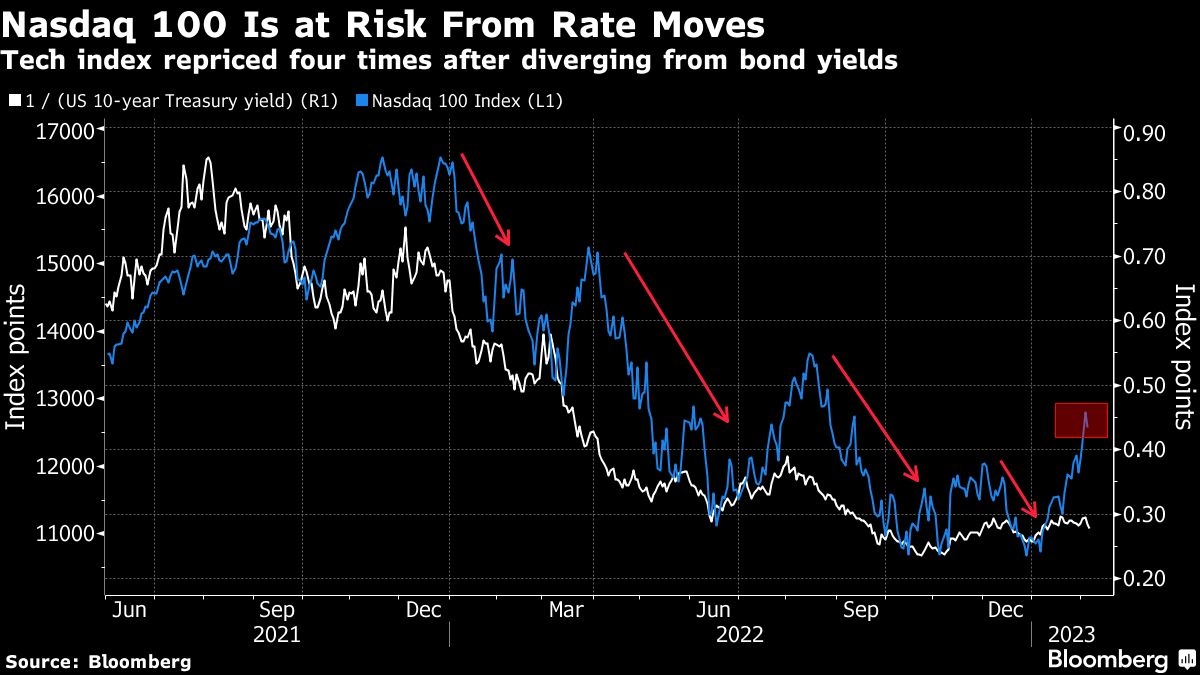

More generally, as rising rates drove a significant decline in the S&P 500, the Bloomberg US Financial Conditions Index, which gauges tightness in the money, bond, and stock markets, has been more restrictive for three consecutive months.

Trader attention was on the Federal Open Market Committee’s assessment that ‘tighter financial and credit conditions for families and companies are expected to weigh on economic activity, hiring, and inflation’, even as Powell on Wednesday left open the prospect of another rise in December.

According to former Fed vice chair Richard Clarida, the difficulty with include financial conditions in the most recent announcement is that they might rise and fall. He also added that policymakers would regret relying on erratic market data.

Jim Reid, head of Deutsche Bank AG’s European and US credit strategy, commented, “We can’t help but wonder whether yesterday’s dovish market reaction could incentivize some hawkish pushback, especially if it continued.” Powell views the continuation of tighter financial conditions as “critical.”

In any event, Wall Street’s obsession with the ways in which asset prices affect demand and drive the cost of finance for firms and consumers in the real economy is understandable. According to Standard Chartered, a more stringent finance environment might reduce baseline economic growth by more than a percentage point in the upcoming year.

In a research note, the bank’s analysts, including Dan Pan, stated that “the run-up in mortgage, corporate, and Treasury yields, combined with a strong USD and weaker equities, raises the expected drag on the US economy.” “The implied downside risk to growth may be overstated, particularly if changes in the corporate bond or equity markets do not adequately reflect the escalation of financial stability concerns.”