Due to the impact of car strikes on the labour market last month, job growth in America slowed in October and the unemployment rate increased somewhat.

The Bureau of Labour Statistics released figures on Friday showing that nonfarm payroll growth reached 150,000 in October, but the unemployment rate increased to 3.9% from 3.8%. Right present, the jobless rate is at its highest point since January 2022.

According to a Bloomberg survey of economists, job additions would total 180,000, and unemployment would remain unchanged from the previous month.

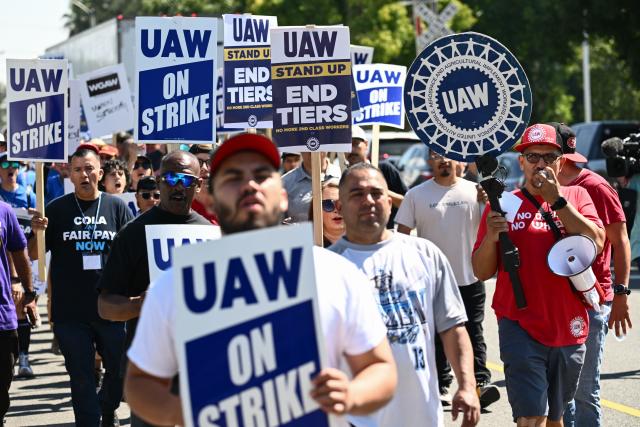

According to the Bureau of Labour Statistics (BLS) report, the United car Workers’ (UAW) strikes at three major car manufacturers’ factories resulted in a 35,000 decrease in manufacturing employment in October. These strikes also had an impact on hiring. The UAW and the automakers came to a provisional agreement earlier this week to put an end to the strikes.

The September estimate was strong, but it was cut down by 39,000 jobs on Friday. The October report comes after that.

“There is more weakness beyond that, but some of [October’s] weakness will reverse next month with the UAW strike ending,” US economist Thomas Simons of Jefferies said in a note to clients following the release of the data.

Pay increases this month were smaller than anticipated. Wages are a carefully studied measure of inflation and the degree of bargaining power that workers have in the labour market. Pay rose 4.1% over the previous year and by 0.2% on a monthly basis; analysts had predicted a 4% increase over the previous year and a 0.3% increase over the previous month.

The rate of labour force participation dropped from 62.8% to 62.7% in the previous month. Additionally, the average weekly hours decreased little from 34.4 in September to 34.3 now.

58,000 new jobs were gained in the healthcare sector, which had the biggest job growth in Friday’s report. 51,000 more people were employed by the government, returning it to its pre-pandemic level.

Given that equities have risen following the Federal Reserve’s most recent policy decision, the employment report arrives at a critical moment for the markets. The majority of investors are placing bets that, based on Fed Chair Jerome Powell’s remarks on Wednesday, the Fed won’t raise rates in December and may end this cycle’s rate hikes entirely.

Powell said during a press conference on Wednesday that the labour market would probably need to slow down a little bit in order for inflation to keep falling.

“It is still likely to be true — not a certainty, but likely — that we will need to see some slower growth and some softening … in labour market conditions to fully restore price stability,” Powell stated.

According to the CME FedWatch Tool, as of Friday morning, markets were pricing in a probability of around 90% that the Fed won’t hike rates at its upcoming meeting, an increase of approximately 10% from the day before.

“Powell did not seem particularly eager to raise rates again at the December meeting when he made his post-FOMC comments on Wednesday,” Simons said on Friday, “and nothing here says that he should be changing his mind.”