As of now, we know that return on equity (ROE) gauges how well a business makes money. The amount of profit that the firm “retains” for future expansion must now be assessed in order to determine its potential for growth. If everything else stays the same, a company’s growth rate will be better if its ROE and profit retention are higher than those of firms that don’t necessarily have these traits.

Thermo Fisher Scientific appears to have a respectable ROE at first look. Additionally, the company’s ROE is comparable to the 12% industry average. Among other things, this undoubtedly helps to explain Thermo Fisher Scientific’s modest 17% increase over the last five years.

Thermo Fisher Scientific’s claimed growth is comparable to the industry average growth rate of 21% over the past several years, according to our comparison of the company’s net income growth with that of the industry.

A significant determinant of stock pricing is earnings growth. The second thing that investors must ascertain is if the share price already accounts for the anticipated expansion in earnings, or not. By doing this, they will be able to determine if the stock’s future is bright or bleak. Is TMO a reasonable price? Everything you require to understand the company’s intrinsic worth is included in this infographic.

In the case of Thermo Fisher Scientific, its low three-year median payout ratio of 5.8% (or a retention ratio of 94%) implies that the company is investing the majority of its profits to expand its operations, which likely explains its solid earnings growth.

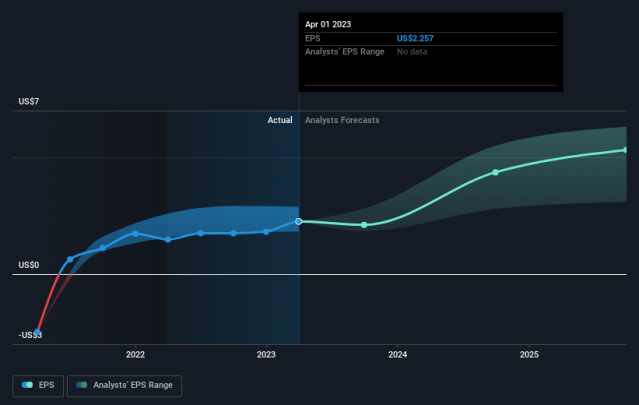

Furthermore, based on its lengthy history of paying dividends for a minimum of 10 years, we may assume that Thermo Fisher Scientific is committed to continuing to distribute its profits to shareholders. We looked at the most recent analysts’ consensus data and discovered that, for the next three years, the firm is likely to continue paying out around 6.0% of its profits. However, even if the payout ratio isn’t likely to move much, Thermo Fisher Scientific’s ROE is forecast to increase to 18% in the future.

We believe that Thermo Fisher Scientific has performed admirably overall. It’s particularly encouraging to observe that the firm is making significant investments in its operations, which, along with a strong rate of return, have contributed to a sizable increase in earnings. In light of this, an analysis of the most recent analyst projections indicates that a decrease in the company’s future profits growth is anticipated. Do these analysts’ projections stem from the industry’s general expectations or from the company’s core strengths and weaknesses? To view our analyst’s forecast page for the firm, click this link.