Despite not having the biggest market capitalization, Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL) has had a notable 47% increase in share price during the last several months on the NASDAQCM. The firm is trading near to its 52-week high as a result of the recent increase in share price. There is typically more room for mispricing in small size stocks since there is less activity driving the stock closer to fair value and because these stocks typically don’t have a lot of analyst attention. Is this still a chance to make a purchase? Let’s take a closer look at Pangaea Logistics Solutions’s outlook and valuation to see whether there is still room for improvement.

The company is overpriced by 27% at its current share market price of US$8.09 when compared to our intrinsic value of $6.36. Not ideal news for prospective buyers who are investors! It’s also important to remember that Pangaea Logistics Solutions’s low beta suggests that its share price is quite steady in relation to the market. As a result, if you think the present share price will eventually rise to its intrinsic worth, a low beta may indicate that it is unlikely to do so very soon. Once it does, it could be difficult to return to an appealing purchasing range.

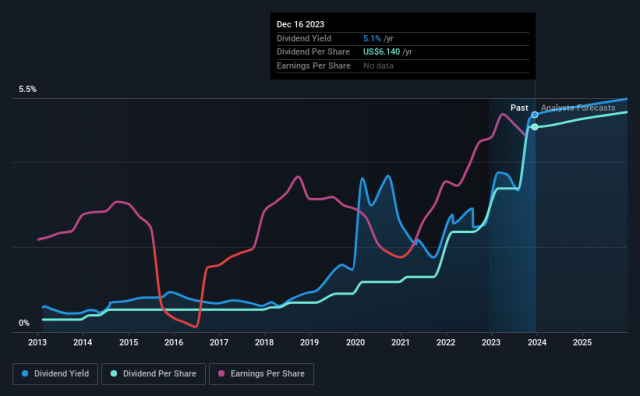

When considering a stock purchase, the future outlook is crucial, particularly if you’re an investor hoping to expand your portfolio. A stronger investment thesis would be significant growth potential at a low price, even though value investors would contend that the inherent value in relation to the price is what matters most. However Pangaea Logistics Solutions is predicted to have a negative rise in earnings of -6.1%, which undermines the company’s investment thesis. For the time being at least, it seems like there is a significant chance of future unpredictability.

It might be advantageous to sell high and then purchase PANL back up when its price drops to its true worth if you think it should trade below its present level. It could be a good idea to lower the overall risk of your portfolio at this time, given the uncertainties around potential negative growth. However, consider if its foundations have altered before making this choice.

It might not be the ideal moment to buy PANL stock if you’ve been watching it for a while. The stock of the firm has increased above its actual value, and its future prospects are uncertain. But there are other crucial elements that we haven’t covered today, such the company’s financial stability. When the price drops in the future, will you be knowledgeable enough to make a purchase?