Although The Chemours firm (NYSE:CC) is not the biggest firm in the world, it has drawn a lot of interest due to a significant price volatility over the previous several months on the NYSE, rising to US$38.51 at one point and falling to US$23.58 at the lowest. Investors may have a better opportunity to enter the stock market and maybe purchase it at a reduced price during certain share price swings. Is Chemours’ present trading price of US$23.58 indicative of the mid-cap’s true value? is a question that has to be answered. Or is it now priced too low, giving us the chance to purchase? Using the most recent financial data, let’s examine Chemours’s outlook and value to see whether there are any factors that might lead to a price shift.

My discounted cash flow valuation suggests that Chemours is now overvalued by 21%. The market price of the stock is now US$23.58, whereas my intrinsic value is $19.53. This implies that there is no longer a chance to get Chemours at a discount! Should you find the stock appealing, you might wish to monitor any future price reductions. Given how erratic Chemours’s share price is, there’s a risk it may drop (or climb) even more in the future, providing us with another opportunity to invest. This is because of its high beta, a reliable measure of how much the stock fluctuates in relation to the market as a whole.

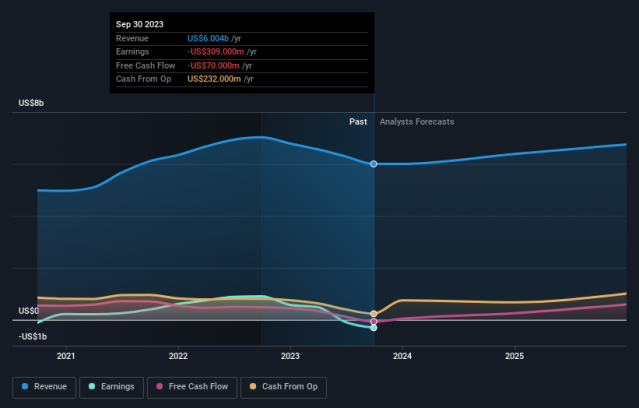

It may be a good idea for investors seeking portfolio growth to think about a company’s future before purchasing its shares. It’s usually a smart idea to purchase a strong firm at a low price, therefore let’s also look at the company’s projected future growth. For the next few years, sales are predicted to increase by double digits, or 11%. Chemours’ forecast is favourable. It appears that greater cash flow for the company is anticipated if the current level of spending is maintained, and this should contribute to a higher share price.

The present share price of CC looks to have taken into account its anticipated growth in the future, since the shares are trading above their fair value. Shareholders may be asking themselves a different question now: should I sell? Selling high and then buying it back up when the price drops to its true worth might be advantageous if you think CC should trade below its present price. But first, consider if the basics of this choice have altered.

It might not be the ideal time to buy CC stock if you’ve been watching it for some time. There is no profit potential from mispricing because the price has risen above its actual worth. To take advantage of the next price reduction, it is worthwhile to delve further into other elements, since the positive outlook is favourable for CC.

To learn more about Chemours as a company, it’s critical to understand the dangers it faces. Chemours, for instance, has three warning indicators that we believe you should be aware of.