Even though Guess?, Inc. (NYSE:GES) isn’t the most well-known stock right now, during the past several months, its share price on the NYSE has grown in the teens. We would anticipate that any news that may affect the stock’s price has already been taken into account by the many analysts that follow the company. But what if there’s still time to make a purchase? To ascertain whether there is still a good deal available, let’s take a closer look at Guess?’s value and future prospects.

Happy news for investors! My price multiple model, which contrasts the company’s price-to-earnings ratio with the industry average, indicates that Guess? is still a good deal at this time. In this case, the price-to-earnings (PE) ratio was utilised since it provides a reliable estimate of the stock’s cash flows in the absence of other information. In my opinion, Guess?’s ratio of 7.89x is less than its peer average of 10.87x, implying that the company is being sold for less than the Specialty Retail sector’s going rate. Nevertheless, there could be another opportunity to purchase in the future. This is because Guess? has a high beta, which indicates that its price swings will be inflated in comparison to the market as a whole. Beta is a measure of share price volatility.

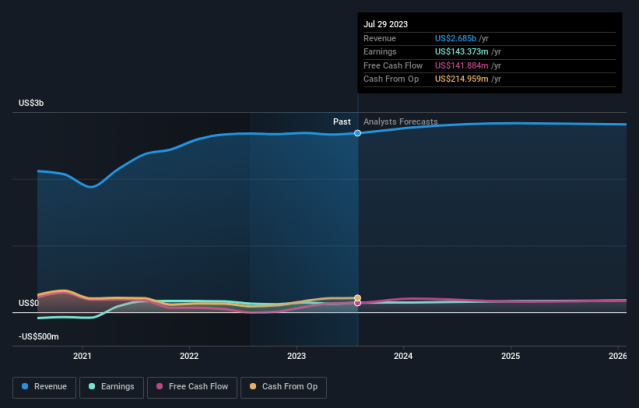

When considering a stock purchase, the future outlook is crucial, particularly if you’re an investor hoping to expand your portfolio. A stronger investment thesis would be significant growth potential at a low price, even though value investors would contend that the inherent value in relation to the price is what matters most. Guess?’s earnings are predicted to rise by 20% over the next five years, pointing to a very promising future. Stronger cash flows as a result ought to increase the share value.

Now could be a fantastic moment to increase your holdings in GES since the company is selling below the industry PE ratio. It appears that the share price has not yet completely taken into account this rise, especially given the promising profit expectation for the future. But there are further variables to take into account, such financial stability, which may account for the present price multiple.

This might be your chance to take a chance if you’ve been watching GES for some time. It is still possible to purchase GES because its bright future earnings potential isn’t completely represented in the share price at this time. However, in order to make an informed investment selection, take into account other criteria before making any judgements, such as the soundness of its balance sheet.

In light of this, we wouldn’t think about buying shares unless we were well aware of the hazards. We discovered three Guess? caution signs at Simply Wall St. and we believe they merit your consideration.

In the event that Guess? no longer piques your attention, you may view our list of more than 50 stocks with strong growth potential by using our free platform.