The investment base of Teradyne, Inc. (NASDAQ: TER), a top provider of automation equipment for testing semiconductors, has recently seen some substantial changes. While institutional investors continue to own the majority of Teradyne’s stock, a number of significant investors have modified their positions in the company.

In the second quarter of this year, Exchange Traded Concepts LLC grew its stake in Teradyne by 8.8%. The company now owns 18,962 more shares of Teradyne stock, totaling 234,375, for a market capitalization of $26,093,000. Similar to this, during the same quarter, ICICI Prudential Asset Management Co Ltd increased its holdings in Teradyne by 11.4%. After acquiring an additional 8,550 shares, they now hold 83,677 shares worth $9,316,000.

It is interesting that during the second quarter, Nelson Van Denburg & Campbell Wealth Management Group LLC, Foundations Investment Advisors LLC, and Cornell Pochily Investment Advisors Inc. all took up new positions with Teradyne. Foundations Investment Advisors and Nelson Van Denburg & Campbell Wealth Management Group each bought positions worth about $216,000 and $370,000, respectively, while Cornell Pochily bought a stock worth about $405,000.

These adjustments show that institutional investors continue to be intrigued by Teradyne’s prospects for expansion and success in the semiconductor sector. At the moment, institutional investors control about 99.77% of the company’s stock.

Other insider trading-related news includes the sale of 750 shares of Teradyne stock by Director Mercedes Johnson on July 17 at an average price of $115 per share. That deal brought in a total of $86,250. Mercedes Johnson still owns 17,767 shares directly after this trade, which are currently worth $2,043,205.

Brad Robbins, an insider at Teradyne, executed another insider transaction on September 28 by selling 2,170 shares of the company’s stock at an average price of $100 per share. A total of $217,000 was earned from this transaction. Robbins still owns 51,579 shares, which are worth around $5,157,900.

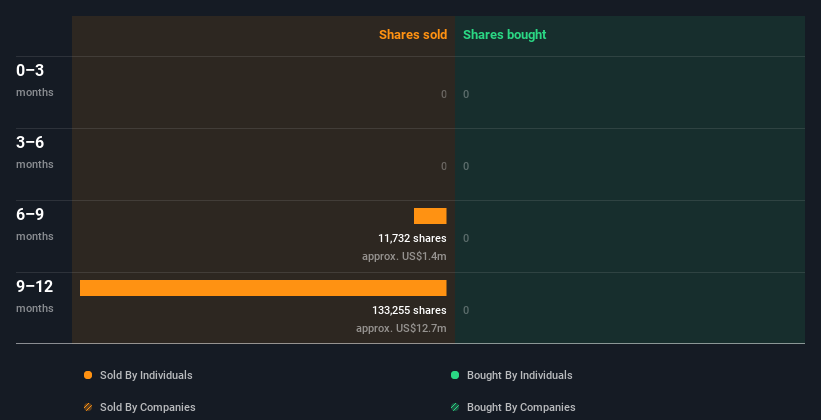

These disclosures were made through legal documents submitted to the Securities & Exchange Commission (SEC), and they are openly accessible on the SEC’s website. It is noteworthy that insiders have sold 27,683 shares of Teradyne stock for a total value of $2,860,654 over the most recent three months ending October 6. Currently, corporate insiders control about 0.36% of the company’s stock.

Teradyne has also been the subject of reports from numerous brokerages. On July 18, KeyCorp increased their target price for Teradyne from $117.00 to $140.00. On July 28, Robert W. Baird increased their price objective from $104 to $115. On September 26th, Northland Securities raised Teradyne’s rating from “market perform” to “outperform” and set a target price of $126.00 per share.

On July 28, Citigroup reduced their target price for Teradyne from $125.00 to $127.00. Finally, StockNews.com began to cover Teradyne and assigned it a “hold” rating.

Additionally, according to information from Bloomberg, analysts have assigned the stock the rating “Hold” and have set a consensus price objective of around $108.87 per share.

Teradyne released its financial results for the second quarter (Q2) that ended on June 30 on July 26 of this year. The company outperformed analysts’ consensus projections by $0.13, reporting earnings per share of $0.79 for the quarter. Teradyne’s revenue for the quarter was $684 million, exceeding the $656.94 million forecast.

Teradyne’s Q2 revenue decreased by 18.7% when compared to the same quarter a year prior, yet the business still managed to have a net margin of 19.55% and a return on equity of 23.37%. This accomplishment exemplifies Teradyne’s capacity for flexibility and success in a demanding market context.

Teradyne is expected to report earnings per share of $2.83 for the current fiscal year, which suggests possibilities for expansion and profitability.

Teradyne recently announced a quarterly dividend as part of its dedication to shareholders. On September 25, $0.11 per share in dividends were paid to shareholders with records as of September 1st. This results in a $0.44 per share annualised dividend rate, or a yield of about 0.44%.

In conclusion, Teradyne has recently attracted a lot of interest from investors. Several prominent investors changed their positions in the firm during the second quarter. Institutional investors’ interest demonstrates their belief in Teradyne’s potential in the semiconductor sector.

There has also been evidence of insider trading, with notable sales made by Director Mercedes Johnson and insider