which is why the news that C&F Financial Corporation (NASDAQ:CFFI) will trade ex-dividend in the following four days is fascinating. One day prior to the record date—the day on which stockholders must be listed on the company’s records in order to be eligible for a dividend—occurs on the ex-dividend date. It is crucial to be aware of the ex-dividend date since any stock purchases done on or after this day may result in a delayed settlement that is not shown on the record date. Therefore, you will not be entitled to receive the dividend when it is paid on January 1st if you buy shares of C&F Financial on or after December 14th.

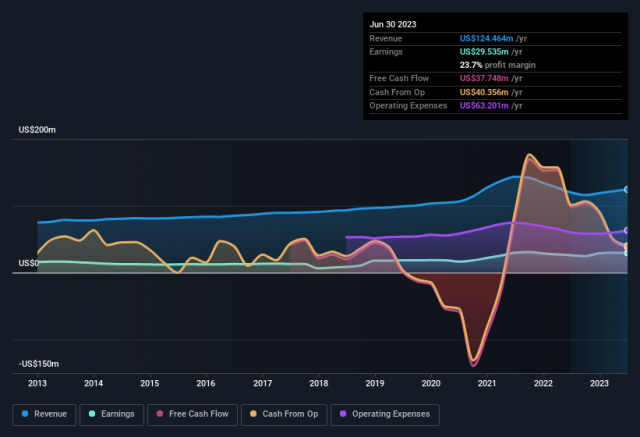

Following a dividend payment of US$1.76 to shareholders last year, the business will make its next dividend payment of US$0.44 per share. At $60.84, C&F Financial’s stock offers a 2.9% trailing yield based on payments made over the last year. If the dividend is the reason you purchased this company, you want to know if C&F Financial’s payout is steady and predictable. We must check to see if the dividend is increasing and if profits are covering it.

Since dividends are often paid from corporate earnings, a company’s payout is typically more vulnerable to reduction if it distributes more money than it makes. Just 21% of C&F Financial’s earnings after taxes is distributed, which is a comfortable amount and provides plenty of leeway in the event of unfavourable circumstances.

A company’s dividend is typically considered reasonable if it paid out less in dividends than it made in earnings. The larger the dividend’s margin of safety in the event that the company experiences a downturn, the smaller the percentage of profit it distributes.

Since dividends are often paid from corporate earnings, a company’s payout is typically more vulnerable to reduction if it distributes more money than it makes. Just 21% of C&F Financial’s earnings after taxes is distributed, which is a comfortable amount and provides plenty of leeway in the event of unfavourable circumstances.

A company’s dividend is typically considered reasonable if it paid out less in dividends than it made in earnings. The larger the dividend’s margin of safety in the event that the company experiences a downturn, the smaller the percentage of profit it distributes.

Is it wise to hold off on investing in C&F Financial or is it an appealing dividend stock? Businesses that are expanding quickly and paying out a small percentage of earnings usually retain their profits to put back into the company. Possibly even more crucially, this can occasionally indicate that management is considering the long-term viability of the company. We believe that this is a quite appealing mix and would like to look into C&F Financial more.