Nike was down more than 11% in New York premarket trade after the firm announced it is seeking for as much as $2 billion in cost cuts despite a lower sales outlook. Futures on the US Nasdaq 100 and S&P 500 both marginally down. After China shocked the industry with new regulations, a selloff also hit the video gaming industry, with double-digit losses at US-listed Chinese brands NetEase Inc. and Bilibili Inc.

Prosus NV experienced a record 20% decline in Europe as a result of the gaming shares selloff, which had previously erased billions of dollars from the value of China’s leading online brands. Ubisoft SA and other competitors also saw declines. Adidas AG and Puma SE, two sportswear companies, suffered as a result of Nike’s poor report.

The US core personal consumption expenditures price index, which is the favoured inflation statistic by the Fed, is traders’ main focus this week ahead of the long Christmas weekend. According to a Bloomberg survey of economists, it decreased to 3.3% in November from 3.5% in October.

The information may give the S&P 500 its first winning run in over five years, lasting eight weeks, and give US Treasuries new life.

Stuart Cole, chief macro economist at Equiti Capital, stated that “today’s PCE numbers, if they print in line with expectations, will simply encourage market views that the FOMC will be cutting rates at either the March or the May meeting.”

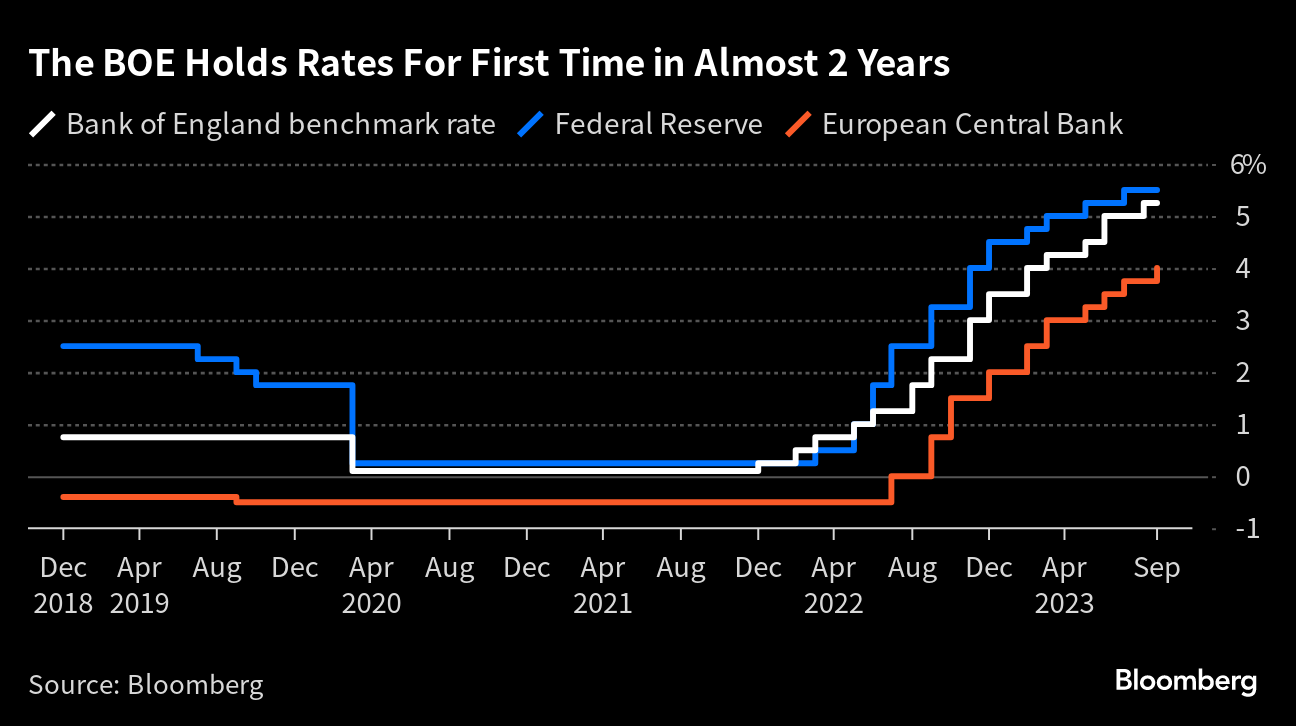

Trader of swaps is pricing in about 150 basis points of Fed cuts for the upcoming year, which is double what the Fed has said. The US dollar is weakening compared to its Group of 10 competitors as a result of such bets, and the yield on the 10-year US Treasury fell three basis points, barely maintaining its five-month lows.

Meanwhile, following reports indicated that the economy contracted in the third quarter, borrowing rates for the British government fell to levels that were almost eight months lower.

The numbers will heighten concerns about the developed world’s economy growing more slowly. Nike’s disappointing performance and the negative revision to the US GDP for the third quarter on Thursday further highlight these worries.

Prior to this, Chinese government bonds had a surge, with ultra-long rates hitting their lowest point in almost twenty years following another round of massive bank deposit rate cuts.

Oil continued to rise for the second week in a row as vessels made long diversions to escape terrorist assaults in the Red Sea. With a projected weekly rise of about 5%, Brent oil futures were trading close to $80 a barrel.