If we want to find companies that have the potential to increase in value over time, what trends should we look for? A company should ideally exhibit two trends: first, a rising return on capital employed (ROCE) and second, a rising capital employment level. This basically indicates that a business has successful projects that it can keep funding, which is a characteristic of a compounding machine. Speaking of which, let’s take a look at some amazing changes we saw in Beazer Homes USA’s (NYSE:BZH) returns on capital.

Beazer Homes USA’s ROCE growth has not let us down. According to the data, ROCE has increased by 172% in the previous five years while using about the same amount of capital. In essence, the corporation is making more money with the same amount of capital, which indicates that its efficiency have improved. Though it’s fantastic that the company is running more efficiently, it’s worth investigating more because this might also indicate that there are gaps in the areas where internal development will require investment in the future.

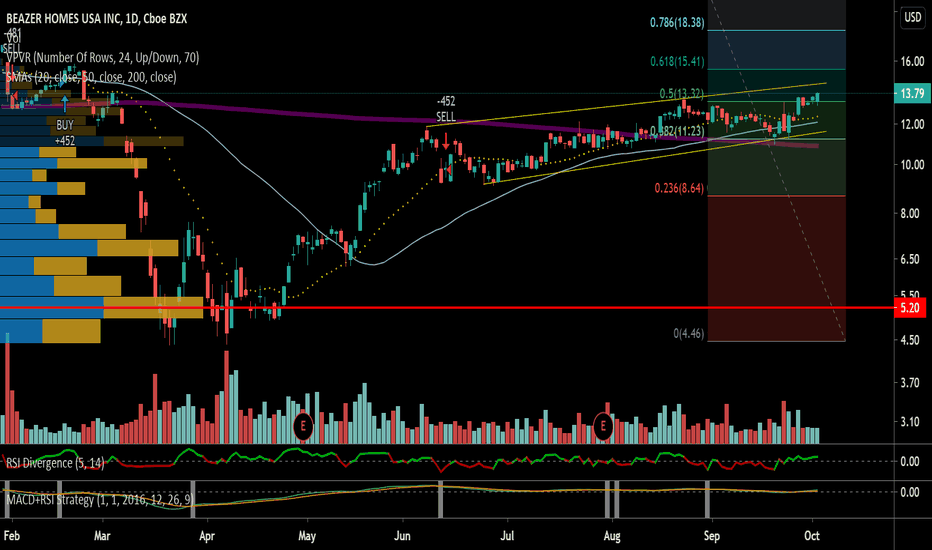

In summary, it’s noteworthy that Beazer Homes USA is generating more returns with the same amount of cash. Investor recognition of these developments appears to be supported by the stock’s astounding 158% return to owners over the previous five years. As such, we believe it would be worthwhile for you to investigate if these patterns are likely to persist.