F5, Inc. (NASDAQ:FFIV) may not be a huge cap business, but during the past several months, its share price has increased by a respectable amount, reaching the teens on the NASDAQGS. You might believe that any recent changes in the company’s outlook are already reflected in the stock because it is a mid-cap stock with extensive analyst coverage. But what if the stock is still a good deal? To determine whether the opportunity is still there, let’s examine F5’s outlook and value based on the most recent financial data.+

My price multiple model, which compares the company’s price-to-earnings ratio to the industry standard, indicates that the share price currently appears to be reasonable. Since there is insufficient data to accurately anticipate the stock’s cash flows, I have in this case employed the price-to-earnings (PE) ratio. I believe that F5’s ratio of 28.08x is trading slightly below the ratio of 29.39x of its industry rivals, indicating that you would be paying a fair price for it today if you choose to purchase it.

If you think F5 should continue to trade at this level over the long term, there isn’t much upside potential relative to other market competitors. Will there ever be another chance to purchase stocks at a discount? Since the price of F5’s stock is highly erratic, it’s possible that it will drop (or rise) in the future, offering us another opportunity to buy. Its high beta, a reliable indicator of how much the stock moves in relation to the rest of the market, is the basis for this.

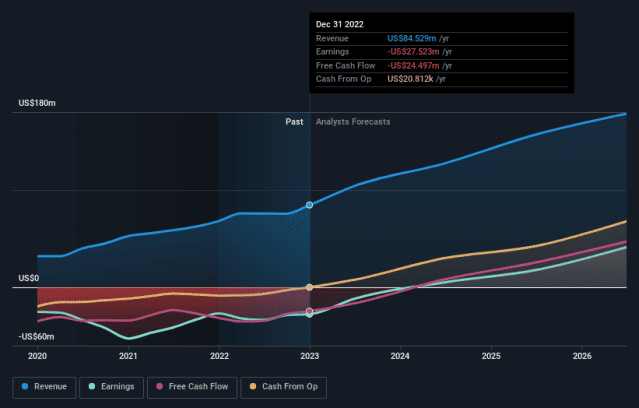

When considering whether to purchase a company, the future outlook is a crucial factor, particularly if you’re an investor trying to expand your portfolio. Let’s also look at the firm’s future predictions since investing in a terrific company with a strong outlook at a low price is always a wise decision. Future prospects appear promising for F5, with profit predicted to increase by 77% over the following couple of years. It appears that the stock will have stronger cash flow, which should result in a better share valuation.

accounted for in the present share price, with shares selling at prices that are multiples of the industry. However, there are still some crucial elements that we haven’t taken into account today, such the management team’s track record. Have any of these elements changed since you last examined FFIV? If the price falls below the industry PE ratio, would you still be willing to invest in the business?

given that it is trading at industry price multiples, now would be the best time to buy. However, the upbeat outlook is good for FFIV, therefore it’s worthwhile investigating other aspects like the health of its balance sheet in order to profit from the subsequent price decline.

It’s important to consider the most recent expert projections because timing is crucial when choosing individual stocks. Fortunately, you may look at

Our articles are not meant to be financial advice; instead, we only offer analysis based on objective methods, historical data, and analyst forecasts. It doesn’t represent an advice to buy or sell any stock, and it doesn’t take into consideration your goals or financial position. We hope to provide you with long-term analysis that is driven by essential facts. Be aware that recent price-sensitive company announcements or high-quality information may not be taken into account in our analysis. No stock mentioned has any positions held by Simply Wall St.