As oil prices had their single worst day of losses dating back to September 2022, the energy sector had the poorest performance on Wednesday. While SLB and Halliburton both experienced declines of more than 4%, Devon Energy and Marathon Oil both experienced declines of about 5%.

Following the announcement of fresh jobs data, Wednesday’s actions. 89,000 new private payrolls were added last month, according to ADP. That is significantly less than the upwardly revised 180,000 payroll additions from August and the Dow Jones prediction of 160,000.

On the basis of the data, Treasury rates slightly declined from their 2007-level highs. The yield on the 10-year Treasury was 4.735% as of recent trading.

There will always be days when you have significant momentum in one direction, and in this situation, rates and stocks have had some relief. From here, the general tendency is actually downward, according to Ross Mayfield, a Baird investment strategy expert.

Mortgage rates have risen to almost 8% as a result of rising interest rates, which have heightened recession fears. The demand for mortgages consequently decreased to its lowest levels since 1996.

Interest rates are “dragging the market around,” according to Jamie Cox, managing partner at Harris Financial Group. “[We’re] seeing a divergence — a big difference — between fixed income and equities,” he continued.

Investors are still on edge and waiting for more clues about the health of the labour market in Friday’s release of the nonfarm payrolls data.

The report comes after a dismal session on Wall Street following reports on job vacancies that showed the labour market is still robust and rising bond yields. The 10-year and 30-year Treasury rates climbed to their highest points since 2007. The Dow, however, had its worst day since March and ended the year in the red.

“I don’t think you get a broader [rally] participation until rates ease up, and that’s only if rates ease without some sort of financial crisis or hard landing recession,” said Mayfield. “Every day that we have such high rates and on a daily basis” lessens the likelihood of a smooth landing in 2024 and points deeper into constrictive terrain.

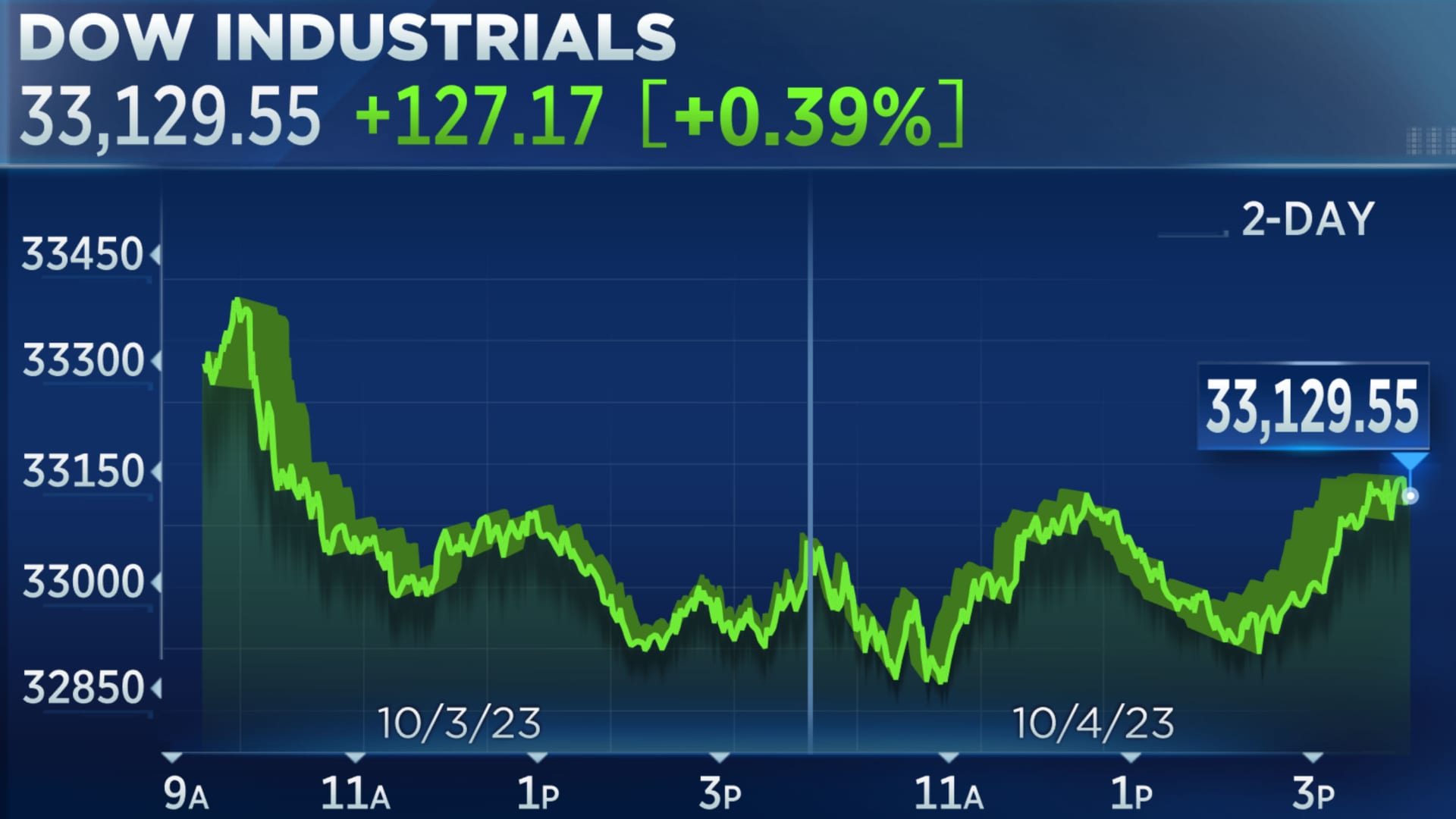

On Wednesday, U.S. stocks ended the day higher.

To close at 33,129.55, the Dow Jones Industrial Average gained 127.17 points, or 0.4%. S&P 500 increased 0.81% to 4,263.75. At 13,236.01, the Nasdaq Composite increased 1.35%.

Although his portfolio was already set up defensively, Andrew Smith, chief investment strategist at Delos Capital Advisors in Dallas, told CNBC that he is increasing exposure to utilities.

While rates may still rise slightly, Smith added, “we think the defensive side still makes sense with this move.”

The expert emphasised that real rates are currently positive and that the recent decline in utilities has brought the industry to its lowest position in more than three years.

Smith continued, “That makes this an appealing entry point for us as we rebalance.”

Carter Worth, CEO of Worth Charting, is betting against the grain by anticipating a weaker currency, lower interest rates, and lower oil prices.

“I think when you get so much crowding and the sequence calls for a counter trend, try to play for it,” Worth said on Wednesday’s episode of “The Exchange” on CNBC. “In my opinion, now is the right time to be buying bonds and selling the dollar.”

Worth’s prediction may provide investors who anticipate a stock market rally at year’s end more ammunition because falling interest rates often increase stock prices. Worth, however, issued a warning that not all asset class correlations are entirely inverse, and he now predicts that by the end of 2023, the market will have both lower rates and lower stock prices.

According to Ned Davis Research, investor pessimism on stocks is at levels that have historically coincided with excellent buying opportunities.

The company stated in a client update on Wednesday that its Daily Trading Sentiment Composite is in its “extreme pessimism zone,” which, since 1994, has been followed by an average annualised gain of 26.7%, with positive returns occurring 80% of the time.

One warning: Investor sentiment towards both stocks and bonds is negative. A “full risk-off environment” that sees a bond rise and further equity slide, leading to a capitulation on equities and a year-end rebound, is one possible outcome, the note stated.