Multiple record-breaking performances in the world’s largest equities market pushed the S&P 500 temporarily above 5,100. The “Magnificent Seven” group of megacaps underperformed, with Nvidia Corp. seeing a slight rise and its valuation hovering around $2 trillion.

“The speed of the tech rally has left investors wondering whether to take profits,” stated Mark Haefele of UBS Global Wealth Management. “While we see merit in rebalancing portfolios, we believe that retaining strategic exposure to US large-cap technology is important.”

According to Michael Hartnett of Bank of America Corp., a surge in AI and confidence about economic growth at a time of relaxing monetary policy are the components of a “magic sauce” that will fuel further increases in stocks. The expert, who has taken a more neutral tone on equities this year after maintaining pessimistic until 2023, stated that a “baby bubble” in AI is “growing up.”

The S&P 500 hardly moved Friday, resulting in a weekly victory. Treasury 10-year rates declined seven basis points, to 4.25%. According to Federal Reserve Bank of New York President John Williams, the economy is on track, and it will most likely be appropriate to lower interest rates later this year.

“We expect the momentum to continue and markets to melt up in the short run, but the stock market story for this year will eventually be about the economy and the Federal Reserve,” said Chris Zaccarelli of Independent Advisor Alliance. “As long as the economy keeps expanding, it’s really hard to interrupt a bull market.”

According to Mark Hackett of Nationwide, the “tug of war” between bulls and bears is now controlled by the bulls, as technical tailwinds merge with favourable underlying trends.

We’ve seen a strong rebound, and there’s still plenty of momentum in the market,” said David Donabedian of CIBC Private Wealth US. “Anyone who goes against it, betting that the market will move in the opposite direction, will be regretful. You do not want to gamble against this market in the short run.”

The jump in Nvidia’s shares in the session after its findings left short sellers with almost $3 billion in paper losses, according to a study by S3 Partners LLC, which described it as a “AI generated nightmare” for pessimistic traders.

The mark-to-market losses are another setback for contrarians who warned that Nvidia’s exorbitant valuations and speculative frenzy had all the makings of a market bubble poised to collapse. According to S3, the chipmaker has borrowed and sold $18.3 billion in shares, making it the third-largest US short position.

While the advance in US technology behemoths has raised concerns about a possible bubble, Barclays Plc strategists say the market movement is in line with earnings fundamentals.

As long as equities move in lockstep with profit expectations, the “fear of missing out” in the tech/AI field will persist, and investors will give expensive valuations the benefit of the doubt, according to the team led by Emmanuel Cau.

Greg Marcus of UBS Private Wealth Management expressed support for the buy-the-dip approach in big tech.

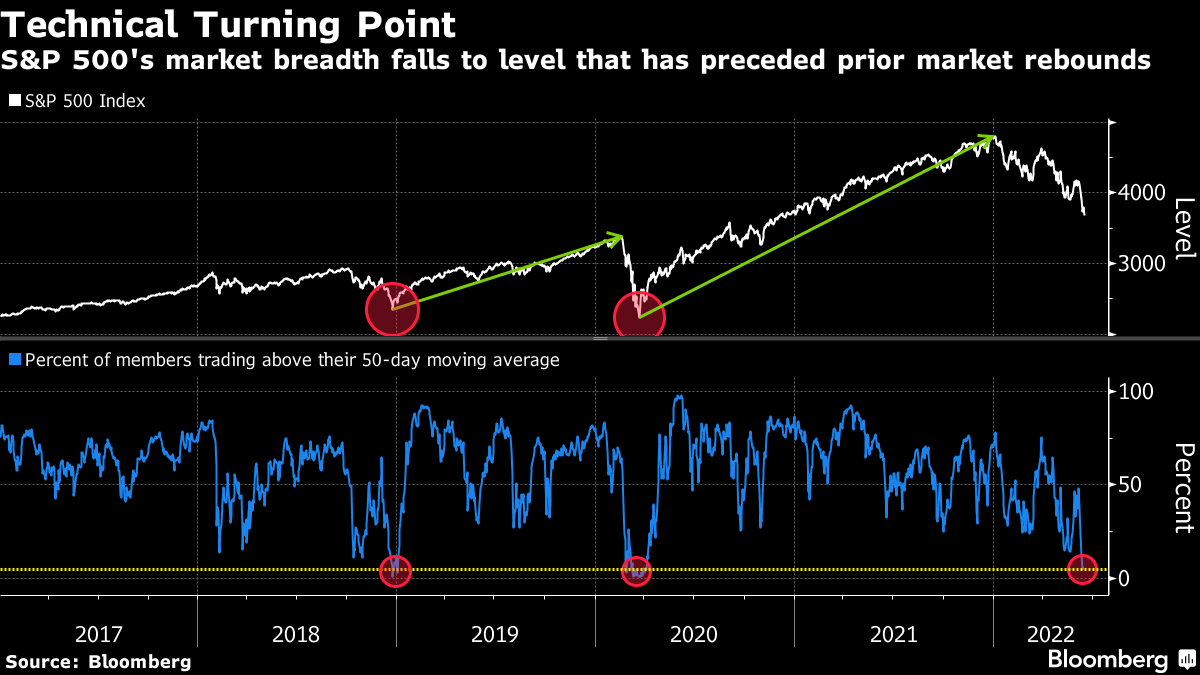

As aggressively as the S&P 500 surged in the session following Nvidia’s blockbuster news, the rally lacked one critical component: robust participation from its members.

Only 73% of the S&P 500 members advanced that day. That was the lowest participation on an up day of this size since the day after the 2020 election, when the index gained 2.2% but only 47% of its members increased.

“Even though market breadth is still narrow, it’s wider than it was last year, with more and more stocks this year outperforming the S&P 500,” he said.

“This should have important implications for how these stocks should be weighted in one’s portfolio — even when an inevitable correction takes place at some point in the future,” he said.

According to Marcus at UBS, if the Fed begins to lower interest rates, it will most likely assist to stimulate greater market breadth.

Meanwhile, Goldman Sachs Group Inc. analysts have moved back their forecast for when the Fed would begin decreasing interest rates to June, citing recent statements from the central bank and minutes from its January meeting.

The US investment bank has reduced its projection for a May cut to four this year, down from five earlier, with movements in June, July, September, and December. It now predicts four further cutbacks next year.