Even businesses with no income, no profit, and a track record of failing can get investors because of the thrill of funding a business that has the potential to turn a profit. But the truth is that investors will often collect their portion of a company’s losses if it has annual losses for a sufficient amount of time. Investors in loss-making firms may be taking on more risk than they should since these organisations are continually in a race against time to achieve financial viability.

If you prefer businesses that make money and don’t align with this type of business, you could be interested in Chicago Atlantic Real Estate Finance (NASDAQ:REFI). While making money

If EPS (earnings per share) growth is maintained annually, corporate value may be generated even in the absence of extraordinary growth. Therefore, it should come as no surprise that some investors choose to fund successful companies. Over the last year, Chicago Atlantic Real Estate Finance has increased its trailing twelve-month EPS from US$1.92 to US$2.01. That is a reasonable 4.6% gain.

When paired with a high profits before interest and taxes (EBIT) margin, top-line growth is a wonderful approach for a business to stay ahead of the competition in the market. It also serves as a great sign of sustainable growth.

It’s important to remember that not all of Chicago Atlantic Real Estate Finance’s revenue this year comes from operations, thus the margin and revenue figures mentioned in this article may not accurately reflect the underlying company. Over the last year, Chicago Atlantic Real Estate Finance increased sales by 27% to US$53 million while maintaining steady EBIT margins. That is definitely a plus.

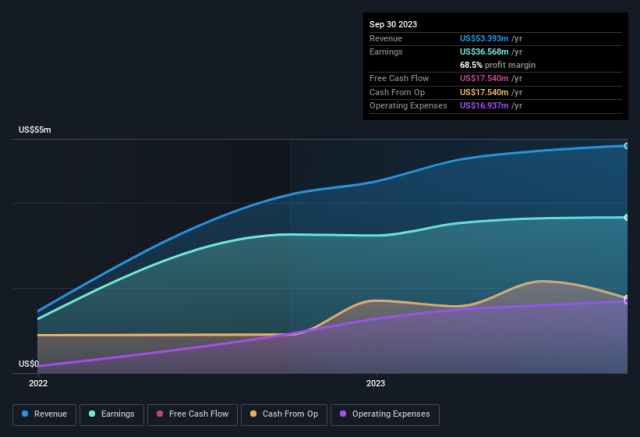

The figure below shows the trajectory of the company’s earnings and sales growth. You may click on the image to get more detail.

It’s important to remember that not all of Chicago Atlantic Real Estate Finance’s revenue this year comes from operations, thus the margin and revenue figures mentioned in this article may not accurately reflect the underlying company. Over the last year, Chicago Atlantic Real Estate Finance increased sales by 27% to US$53 million while maintaining steady EBIT margins. That is definitely a plus.

The figure below shows the trajectory of the company’s earnings and sales growth. You may click on the image to get more detail.

Insiders at Chicago Atlantic Real Estate Finance have steadfastly refused to sell their shares over the past year. The most significant issue, however, is that John Mazarakis, the Executive Chairman of the Board of Chicago Atlantic REIT Manager, paid US$132k to purchase shares at a US$13.19 average price. It appears that at least one insider is prepared to risk money because they see promise for the company’s future.

In addition to insider purchases, insiders’ collective sizeable ownership is another positive indicator for Chicago Atlantic Real Estate Finance. In actuality, their ownership is worth US$42 million. That’s a substantial financial incentive to put forth extra effort.

Growing earnings is one of Chicago Atlantic Real Estate Finance’s most positive aspects. Even better, insiders have been increasing their share purchases and possess a sizable amount of stock. The firm is worth keeping an eye on and researching further only based on these criteria. We should note that before making an investment here, you should be aware of the two warning indicators we’ve found for Chicago Atlantic Real Estate Finance—one of which is rather serious.