A sparse trading session saw a mix of stocks in Asia, with markets closed in Hong Kong, New Zealand, and Australia. The markets in Europe were also closed. The Taiwan dollar and the South Korean won led advances against the declining dollar, which had dropped to its lowest point in over five months. Emerging Asian currencies also rallied. Around the holiday, a rush of transaction news caused the shares of certain US-listed corporations, notably Manchester United Plc, an English football club, to rise.

As the session began the “Santa Claus rally,” a seasonal tendency when stocks tend to soar into the first few days of the new year, some on Wall Street are planning for greater market gains ahead. On Friday, the S&P 500 recorded its longest winning streak in eight weeks.

Regarding developing markets in Asia, “silent night” speaks volumes, as Wall Street is hesitating ahead of Christmas and there isn’t much inspired trade, according to Vishnu Varathan, head of economics and strategy at Mizuho Bank. “Looks like the best case for Boxing Day is to avoid the China pull and hold onto early Santa rallies—boxing in risks.”

In US premarket trading, Manchester United surged as much as 13% on the announcement that UK billionaire Jim Ratcliffe will acquire a 25% interest in the team, valuing it at around $5.4 billion.

In other transaction news, Hollysys Automation Technologies Ltd. saw a 6.6% increase in the US after a group led by Dazheng Group made a better offer to buy the business for $1.8 billion in an attempt to block its sale to Ascendent Capital Partners, a private equity firm. Additionally, 3D printer manufacturer Stratasys Ltd. saw an 11% increase in value after revealing that it had received an unsolicited cash bid of $1.1 billion from Nano Dimensions Ltd.

In mainland China, market morale is still poor despite the authorities’ recent softening of their attitude in response to a plan to tighten restrictions on the gaming sector. This resulted in stock losses, with the benchmark CSI 300 Index falling for the first time in four sessions.

In other news, the Singapore dollar remained mostly stable following a slight decline in core inflation in November, which allowed the central bank to continue its monetary policy pause for an additional month in order to boost the economy.

A measure of demand fell to its lowest level in a year at Japan’s auction of two-year sovereign paper due to a lacklustre response from investors amid rumours the central bank might stop offering negative interest rates in 2024. In November, the labour market in this country remained rather tight, which put pressure on companies to raise pay in order to fill vacancies.

Following Bank of Japan Governor Kazuo Ueda’s remarks on Monday, which indicated he is not in a rush to remove the ultra-easy monetary policy, the benchmark Topix index moved in a narrow range and ended the day up less than 0.1%.

“Year-end selling to lock in profits and losses is likely to weigh on the upside with the Nikkei 225 at high levels,” says Nomura Asset Management senior analyst Hideyuki Ishiguro.

In the business sector, Chinese gaming shares beat the benchmark after many firms declared intentions to buy back their stock in response to the announcement of the most recent government restrictions on the industry. Last Monday, Cathie Wood bought her first shares in LY Corp. in more than a year, suggesting that opinions of the company that runs popular messaging app Line and Yahoo! Japan may be turning more positive.

Due to traders’ strict attention to China’s steel projections for the upcoming year, iron ore futures reached their highest level in 18 months at $140 per tonne. Following the biggest weekly rise in over two months, oil prices declined, with the Red Sea’s shipping delays coming under scrutiny following a wave of Houthi strikes against boats in the crucial waterway.

Given the likelihood of escalating tensions in the Middle East, investors will continue to be concerned about geopolitical tensions in the new year. Israel will pay a price, according to Iranian President Ebrahim Raisi, for the Monday airstrike that killed a top Revolutionary Guard commander in Damascus. Over the weekend, the US accused Iran of attacking a ship in the Indian Ocean.

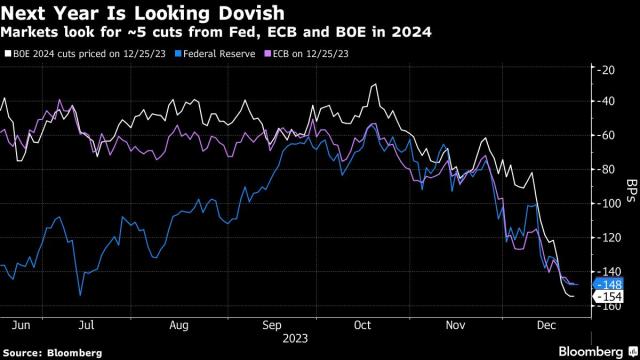

Due to traders’ bets that major central banks, such as the Federal Reserve, will rapidly slash interest rates next year as inflation declines, global markets have recently rebounded. While the S&P 500 is very close to setting a new high, bond rates have dropped.

Data that was made public last week indicated that US GDP was resilient, even though the Fed’s favoured underlying inflation measure barely increased in November. Despite a rocky rebound in the housing market, other statistics released on Friday indicated that consumers were beginning to believe that inflation in the largest economy in the world was headed in the right direction.