In the most recent trading session, U.S. Bancorp (USB) finished at $43.51, moving +0.46% higher than the previous day. The stock moved in a way that exceeded the 0.17% daily rise of the S&P 500. In other news, the tech-heavy Nasdaq gained 0.2% while the Dow dropped 0.05%.

The company’s shares have increased 17.59% over the previous month as of today. The S&P 500 gained 4.71% during that same period, while the Finance sector gained 7.56%.

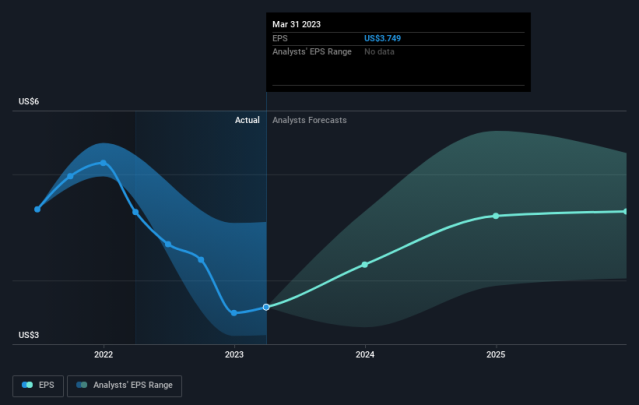

The financial world will be closely monitoring U.S. Bancorp’s profits performance in its next report. On January 17, 2024, the corporation is scheduled to release its profits. It is anticipated that the firm will announce an EPS of $0.99, which represents a 17.5% decrease from the same quarter last year. In the meanwhile, $6.83 billion is predicted to be the revenue, according to the most recent consensus estimate, a 7.78% rise over the same quarter last year.

The Zacks Consensus Estimates for the full fiscal year predict sales of $28.15 billion and earnings per share of $4.31, which would be changes of -3.15% and +16.39% from the previous year, respectively.

Investors should take note of any updates to analyst forecasts for U.S. Bancorp. Current updates often take into account the most recent short-term business developments. In light of this, positive estimate revisions might be interpreted as an indication of hope for the company’s future prospects.

Our findings lead us to conclude that near-team stock fluctuations are directly responsible for these estimate modifications. In order to take advantage of this, we developed the exclusive Zacks Rank algorithm, which combines these estimate changes and offers a useful rating system.

With #1 stocks producing an average yearly return of +25% since 1988, the Zacks Rank methodology, which goes from #1 (Strong Buy) to #5 (Strong Sell), has an outstanding outside-audited track record of outperformance. The Zacks Consensus EPS estimate has dropped by 0.05% in the last month. U.S. Bancorp currently has a Zacks Rank of #4 (Sell).

At the moment, U.S. Bancorp is trading at a Forward P/E ratio of 10.04, which indicates its valuation. This shows no discernible departure from the industry average Forward P/E of 10.04.

It’s also important to remember that the PEG ratio for USB is now 2.01. The PEG ratio is a financial measure that is comparable to the well-known P/E ratio, except that it additionally accounts for the stock’s predicted rate of earnings growth. Based on yesterday’s closing prices, the average PEG ratio for banks and major regional equities is 1.5.

The Finance sector includes the Banks – Major Regional industry. With a Zacks Industry Rank of 166, this industry is now positioned in the lower 35% of all 250+ industries.

By calculating the average Zacks Rank of the individual stocks within the groups, the Zacks Industry Rank evaluates the strength of each of our industry groupings. According to our analysis, there is a two-to-one ratio of performance between the top 50% and worst half of all industries.

In the upcoming trading sessions, be sure to watch all of these stock-moving metrics—and more—by using Zacks.com.