Looking at Eli Lilly & Company’s (NYSE:LLY) stockholders allows us to determine which group is the most influential. Institutions own the greatest number of shares in the corporation, at 88%. Put another way, the group’s investment in the firm will determine how much it gains or loses.

The biggest losses were suffered by institutional investors following the company’s US$23 billion market cap decline last week. Nonetheless, their cumulative losses could have been mitigated by the 61% one-year returns. But they ought to be aware that there may be further losses along the road.

Because institutions report to their own investors primarily against a benchmark, inclusion in a large index tends to boost institutional enthusiasm for a given company. Most businesses should, in our opinion, have some institutions listed on the register, particularly if they are expanding.

Institutions already hold shares in Eli Lilly. They do, in fact, hold a respectable portion of the business. This may suggest that the business enjoys some level of reputation among the investing community. It is advisable to exercise caution when depending on the purported confirmation that comes with having institutional investors, though. They make mistakes occasionally as well. A rapid decline in the share price may occur if several institutions have simultaneous changes in their opinions about a particular firm.

The board will probably need to take institutional investors’ preferences into consideration because they own more than half of the issued shares. Eli Lilly shares held by hedge funds are rather small. With 11% of the outstanding shares, Lilly Endowment, Inc., Endowment Arm is the largest stakeholder, according to our data. With 7.8% of the common stock owned, The Vanguard Group, Inc. is the second-largest stakeholder, followed by BlackRock, Inc. with around 7.3% of the company’s shares.

Further investigation revealed that ten of the top owners make up around 51% of the register, suggesting that smaller shareholders exist in addition to bigger ones, partially offsetting each other’s interests.

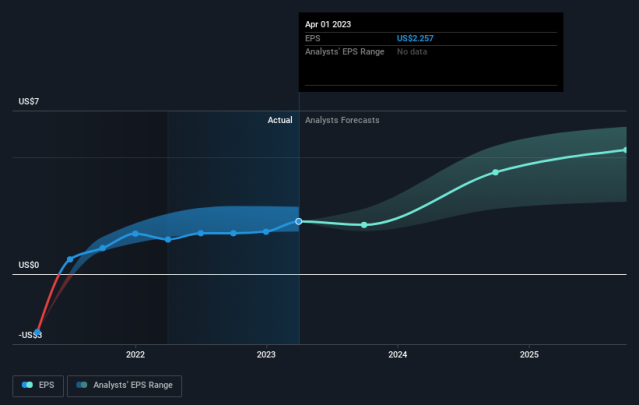

Researching a company’s institutional ownership can be valuable, but it’s also a good idea to look into analyst recommendations to have a better understanding of a stock’s predicted performance. It may be worthwhile to check out the forecasts made by the many analysts that cover the stock.

Although the definition of an insider varies slightly across national borders, board of directors members are always considered insiders. The CEO, even if a member of the board, will report to it; company management runs the firm.

Insider ownership is often seen favourably as it may suggest that the board is in good standing with other shareholders. But occasionally, this group has too much power concentrated within it.

Insider ownership in Eli Lilly and Company is less than 1%, according to our most available data. We wouldn’t anticipate insiders to hold a sizable amount of the stock given how big it is. They together possess shares valued at US$650 million. It’s encouraging to see board members holding stock.