For investors in mega-cap IT companies in particular, November proved to be an excellent month for the US stock market. The tech-heavy Nasdaq Composite increased by 10.7%, while the S&P 500 jumped by 8.9%. Since July 2022, this was the greatest month for the indices.

The MSCI All-Country World index increased by 9% as a result of US equities making up more than 65% of the world market capitalization. This was the strongest monthly performance for global markets since share prices shot up in November 2020 because to news of successful Covid-19 vaccinations.

The Japanese TOPIX gained 5.4% in November, somewhat less than the 6.5% increase made by the STOXX Europe 600. The FTSE 100 in the UK trailed behind, seeing a just 1.8% increase.

Investor optimism that the US Federal Reserve is almost done fighting inflation is the primary cause of the recent global share price boom.

Futures markets are already pricing in rate reductions by the middle of 2024, as many analysts anticipate the US rate-hiking cycle is ended. This might potentially enhance economic development by relieving pressure on governments, firms, and consumers that are too indebted.

So, the hopeful story now goes as follows: interest rates can drop if central banks manage inflation. Furthermore, the cost of riskier assets, such as shares, may increase when interest rates start to decline. But as the adage goes, there’s many a slip between the lip and the cup.

For years, even decades, UK large-cap shares have underperformed relative to their US equivalents. When cash dividends are excluded, the S&P 500 has increased by 74.5% during the past five years. Meanwhile, the Footsie has only increased by 11.1%.

But keep in mind that there was a severe bear market for US markets in 2022, with tech shares suffering the worst losses. In contrast, the FTSE 100 managed to avoid this market catastrophe, increasing by 0.9% in 2022 (not including dividends).

In fact, the Footsie has increased by 5.7% in the two years since December 3, 2021, while the S&P has increased by 1.2%. As a result, during the past 24 months, the UK index has actually outperformed its US cousin, which is something I anticipated but that many commentators could find surprising.

Many pundits and financial writers contend that the London market is always going down. Major corporations choose to list on the more competitive US markets, and the number of firms listed in London continues to decline.

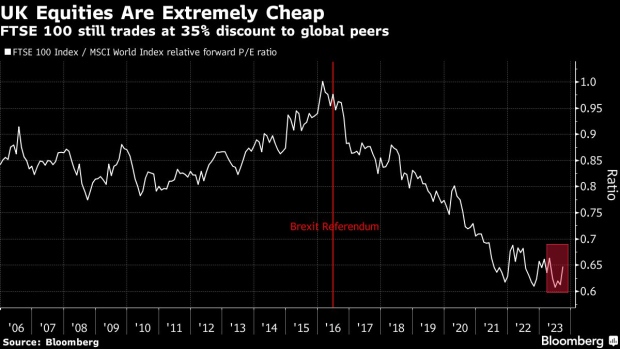

I would contend, as a contrarian, that UK shares are not inherently flawed. This isn’t really a British or even Brexit issue, as around three-quarters of the earnings of FTSE 100 corporations come from outside the country.

In addition, I am aware of one extremely interesting fact regarding the London market: prices are almost at their lowest points ever. The Footsie trades at a reasonable multiple of about 11 times earnings, yielding an earnings yield of 9.1%, while US prices seem stretched to me.