which is why the news that General Motors Company (NYSE:GM) would trade ex-dividend in the following four days is thrilling. The record date, which is the deadline for shareholders to be present on the company’s records in order to be eligible for a dividend payment, is one business day prior to the ex-dividend date. Since settlement takes two full business days, the ex-dividend date is significant. You would thus not appear on the company’s records on the record date if you missed that deadline. Therefore, if you want to collect the dividend, which General Motors will pay on December 14th, you can buy shares of the firm before November 30th.

which is why the news that General Motors Company (NYSE:GM) would trade ex-dividend in the following four days is thrilling. The record date, which is the deadline for shareholders to be present on the company’s records in order to be eligible for a dividend payment, is one business day prior to the ex-dividend date. Since settlement takes two full business days, the ex-dividend date is significant. You would thus not appear on the company’s records on the record date if you missed that deadline. Therefore, if you want to collect the dividend, which General Motors will pay on December 14th, you can buy shares of the firm before November 30th.

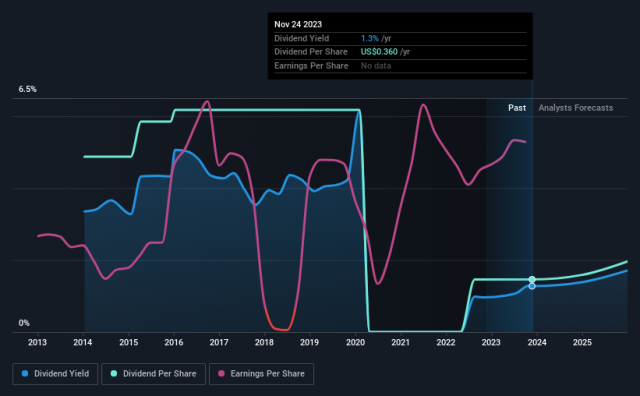

The next dividend payment from the corporation will be US$0.09 per share. The business gave stockholders a total distribution of US$0.36 last year. With its current share price of $28.18, General Motors has a trailing yield of 1.3% based on the total dividend payments made last year. For long-term investors, dividends may make a significant contribution to returns—but only if they are paid consistently. For this reason, we should always make sure the business is expanding and that the dividend payments seem sustainable.

Usually, the company’s earnings are used to pay dividends. A dividend may not be sustainable if a corporation pays out more in dividends than it made in profit. Just 5.0% of General Motors’ earnings after taxes is distributed, which is a comfortable amount and provides enough of leeway in the event of unfavourable circumstances. Analysing if General Motors produced enough free cash flow to support their dividend might be a helpful secondary assessment. The fact that the corporation paid out 5.0% of its cash flow to dividend payers last year indicates that free cash flow adequately financed dividend payments.

The best dividend stocks are often those that have steadily increasing earnings per share since it is typically simpler for them to increase dividends per share. A business slump that results in a dividend decrease might cause the company’s value to drop sharply. The fact that General Motors’ earnings have increased by 100% annually over the last five years is positive. With its rapidly increasing earnings per share and practise of reinvesting the majority of its profits back into the company, General Motors appears to be a true growth corporation.

The majority of investors see the past rate of dividend increase as their primary indicator of a company’s dividend prospects. Over the last ten years, General Motors’s dividend payouts per share have decreased at an underwhelming average rate of 11% annually. It’s not common to have rising earnings per share accompanied with falling dividends per share. Although we would hope it’s because the company is making significant investments in its operations, it might potentially mean that business is erratic.

In light of the impending dividend, should investors purchase General Motors? It’s commendable that General Motors is increasing its earnings per share even if it is only allocating a small portion of its profits and cash flow. Although it is disheartening to learn that the dividend has been reduced at least once in the past, the low payout ratio currently indicates a cautious attitude to payouts, which we appreciate. We would emphasise examining General Motors more because there are many positive aspects regarding the company.

In light of this, knowing about any hazards that the stock is now facing is an essential component of doing extensive stock research. General Motors, for instance, has two warning indicators that we believe you should be aware of.