Finding the market-beating stocks is the primary goal of stock selection. Finding enough winners to more than offset the losses is the fundamental objective, though. Considering that the share price of U.S. Physical Therapy, Inc. (NYSE:USPH) has dropped 26% over the previous five years, some shareholders may now be hesitant to continue with their investment. The share price has dropped 13% in the previous three months, signalling an acceleration of the declines. We observe that the business has only lately released results, and the market is not exactly thrilled. The most recent figures are available in our corporate report.

“Ships will sail around the world, but the Flat Earth Society will flourish,” said Buffett. In the marketplace, there will always be significant differences between price and value. Examining the shift in profits per share (EPS) in relation to share price movement is a crude but straightforward method of gauging how the market views a firm.

Over a five-year period, U.S. Physical Therapy was able to raise EPS by 1.8% annually on average, despite the share price declining. One can assume, based on the share price reaction, that EPS is not a reliable indicator of the company’s performance during the period (perhaps because of a one-time gain or loss). Conversely, growth projections may have been exaggerated in the past.

These figures lead us to believe that, at least five years ago, the market may have been too enthusiastic about projected growth. Other measures might provide a more compelling explanation for the share price movement.

As dividends go, we don’t believe that the 2.0% is a significant effect on the share price because it is quite little. Over the course of the five years, revenue has actually climbed by 5.4% annually, in contrast to the share price. A closer look at the profits and revenue may or may not provide an opportunity as to why the share price is stagnant.

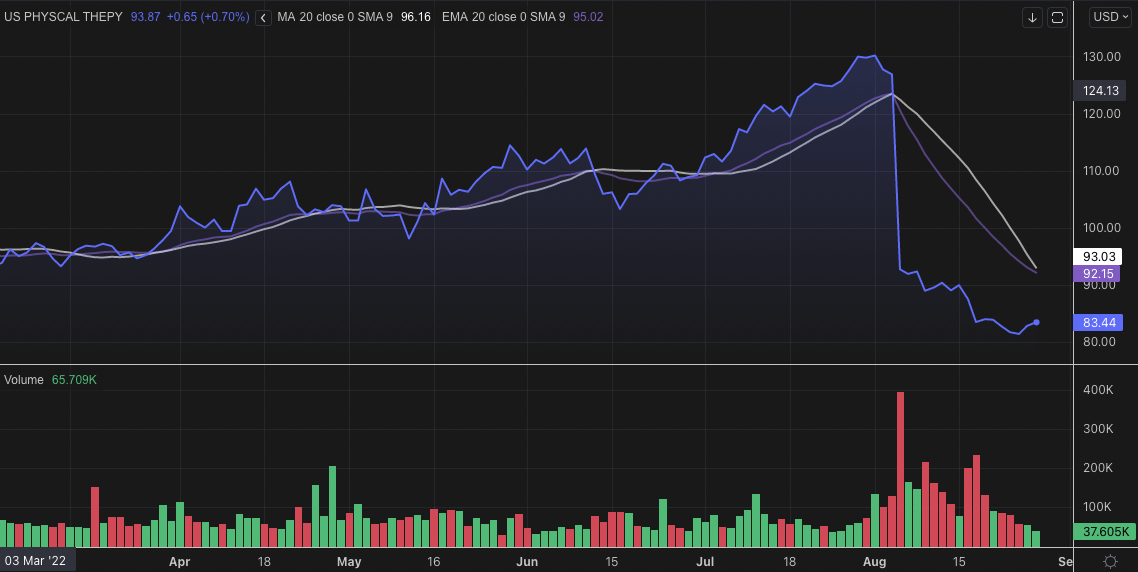

The graph below illustrates the evolution of earnings and sales over time; clicking on the graph provides more details.

The distinction between share price return and total shareholder return (TSR) should be taken into account when examining investment returns. On the presumption that dividends are reinvested, the TSR includes the value of any spin-offs and discounted capital raisings in addition to any dividends. It’s reasonable to argue that for dividend-paying equities, the TSR provides a more comprehensive view. For the last five years, U.S. Physical Therapy has had a TSR of -21%. That surpasses the return on its share price that we previously discussed. And there’s no reward for speculating that the discrepancy is mostly explained by the dividend payments!

Throughout the year, shareholders of U.S. Physical Therapy had a 5.3% total return. Regretfully, this does not meet the market return. Still, that’s a gain at least! Over a period of five years, there has been a 4% annual decrease in the TSR. Thus, this might indicate that the company’s fortunes have changed. Following the performance of share prices over an extended period of time is always intriguing. However, there are a lot of other things we must take into account in order to fully comprehend physical therapy in the United States. In light of this, you ought to be aware of the three red flags that we have identified with U.S. Physical Therapy.