After the Thanksgiving holiday, Friday’s low-volume trading day resulted in mixed closing results for US markets.

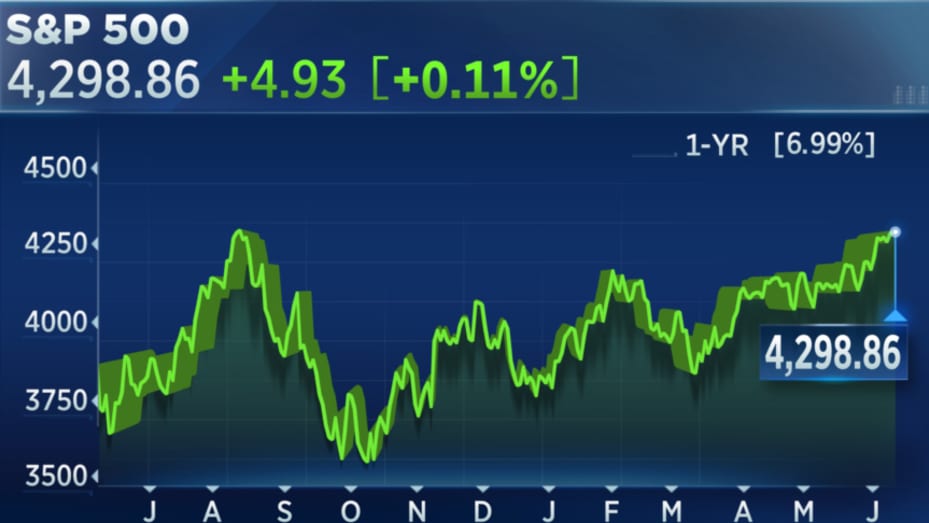

While the benchmark S&P 500 (^GSPC) stayed near to the flatline, the Dow Jones Industrial Average (^DJI) ended the day up almost 0.3%, or more than 100 points. The tech-heavy Nasdaq composite (^IXIC) fell by about 0.1%, behind the market.

For the fourth consecutive trading week, all three main indexes ended the week higher, ensuring that November will go down as the strongest month for the Dow since October 2022. It looks like the S&P 500 and Nasdaq will have their best month since July 2022.

Bond rates increased, with the 10-year Treasury note (^TNX) trading at 4.48%, up almost 6 basis points.

As the Christmas shopping season begins with Black Friday, retailers have outpaced the overall market. As the week came to a conclusion, gains were made by Home Depot (HD) and Best Buy (BBY), leading the S&P retail sector (XRT) to close up around 0.6%.

Large retailers like Walmart (WMT) and Target (TGT) finished higher as well, despite a warning that frugal shoppers are being careful with their money. As consumers become more discerning, retailers are running their Christmas deals earlier and longer.

As it gets ready to launch the first-ever NFL Black Friday game in an effort to draw in more viewers, Christmas shoppers, and higher-paying advertisers, Amazon (AMZN) concluded the brief holiday trading day flat.

See also: 6 strategies to cut costs while making your Black Friday shopping list.

Crude prices were contained by OPEC+’s discord after the organisation of oil-producing nations announced that its upcoming meeting will be conducted virtually. A disagreement about quotas between Saudi Arabia and African nations caused the conference to be postponed, according to Bloomberg.

After dropping 1.3% over the previous two days, Brent oil futures (BZ=F) slightly declined to trade at little over $81 per barrel. Following the trading break for Thanksgiving, West Texas Intermediate (WTI) oil futures fell by around 1% to trade at roughly $76 per barrel.

Nvidia’s (NVDA) shares fell by about 2% after Reuters revealed that the company has postponed the release of an AI chip in China that complies with US export restrictions. Nvidia stated in this week’s earnings that the new US limitations will negatively impact company performance.

rising to reach its highest level since May 2022 at one point during the day, trading above $38,000. On the announcement, Coinbase (COIN), a cryptocurrency broker, saw a 6% increase in shares.

Another popular stock on the Yahoo Finance site, Tesla (TSLA), had a 0.5% increase after CEO Elon Musk called it “insane” that a walkout that began with seven repair shops had expanded to Sweden and that postal workers were now refusing to carry packages to Tesla headquarters.