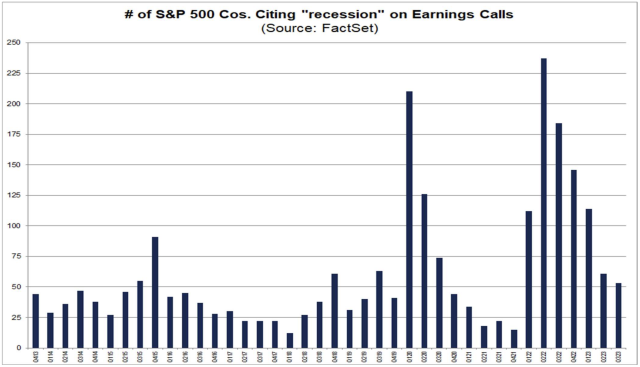

According to recent statistics from FactSet, references to the “recession” are expected to decline for a fifth consecutive quarter, hitting their lowest point since the fourth quarter of 2021.

53 of the 470 S&P 500 companies that have released their quarterly results as of last Friday had addressed the recession. That is a decrease from 237 in the second quarter of 2022, when this cycle peaked, and 61 in the previous quarter.

The average number of S&P 500 firms that have mentioned recessions during the past five and ten years is sixty, and eighty, respectively.

But according to FactSet’s research, the team is looking for the term “recession,” not “slowdown” or other catchphrases that can indicate future bad consumer demand as a whole.

A look at a sample of recent retail results reveals that although businesses aren’t directly discussing a recession, they are also not precisely forecasting that the “resilient consumer” narrative that drove the 2023 economic story would not be impacted.

Walmart (WMT) released a conservative sales estimate last week, which caused its shares to trade down.

On Tuesday, shares of Best Buy (BBY) and Lowe’s (LOW) fell as the latter claimed that this year’s sales will be lower than anticipated while the former stated that demand has been “uneven and difficult to predict.”

Although the recession wasn’t specifically addressed, the message is still clear: Consumer spending is undoubtedly suffering, even if it doesn’t completely decline.

Nevertheless, the story aligns with the recent changes in the language used by Wall Street regarding a slowdown.

There was a time when Wall Street experts agreed that there will be a recession in 2023. That is no longer entirely true.

A “soft landing,” in which inflation drops to the Federal Reserve’s objective of 2% without the economy entering a recession, is now priced in by many investors.

Chief economist of Goldman Sachs, Jan Hatzius, recently released the company’s 2024 outlook, which includes a 15% probability of a recession in 2024. This is consistent with US economic history, which shows that recessions happen around every seven years.

Nor is Goldman alone himself. In response to the US economy’s surprise performance in the second and third quarters of this year, the staff of the Federal Reserve lowered their predictions for a recession in 2023, and the economists at Bank of America also withdrew their call for a dip earlier this year.

A large portion of these updated storylines have focused on how consumers have fared better than most anticipated, with third-quarter growth in the US economy being the strongest in over two years thanks to consumer spending.

Furthermore, Hatzius thinks that this pattern won’t definitely finish in 2024 since real personal income—that is, consumer income after inflation has been taken into account—has been rising as inflation has decreased.

“[The real disposable savings rebound] should be sufficient to keep consumption growing at an OK pace, 2% or so,” Hatzius stated. “Nothing super rapid, but moderate growth would be my expectation, even with reduced excess savings.”