We’ll go over one method of calculating Tyson Foods, Inc.’s (NYSE:TSN) intrinsic value today, which involves taking the anticipated future cash flows and discounted them to their present value. For this, we will make use of the Discounted Cash Flow (DCF) model. Though it can seem complicated, there isn’t actually much to it.

In general, we think that the present value of all the future cash that a firm will create represents its value. A DCF is not perfect, though; it is but one valuation metric among several. Anyone who wants to study up on intrinsic worth a little bit further might check out the

Because Tyson Foods is a food firm, its value must be determined significantly differently from that of other equities. Dividends per share (DPS) payments are utilised in place of free cash flows, which are difficult to forecast and frequently not provided by analysts in this business. This approach usually undervalues the shares unless the corporation distributes the majority of its free cash flow as dividends. We employ the Gordon Growth Model, which makes the assumption that dividends will increase at a sustainable pace indefinitely. A highly cautious growth rate that doesn’t surpass a company’s Gross Domestic Product (GDP) is employed for a variety of reasons. In this instance, we employed the 10-year government’s 5-year average.

It is noteworthy to mention that the discount rate and the actual cash flows are the two most crucial inputs in a discounted cash flow. It’s not necessary to agree with these inputs; instead, I suggest performing your own calculations and experimenting with them. The DCF does not provide a complete picture of a company’s potential performance since it does not account for an industry’s potential for cyclicality or a company’s future capital requirements. The cost of equity is utilised as the discount rate because Tyson Foods is a prospective shareholder, as opposed to the cost of capital, or weighted average cost of capital, or WACC, which takes debt into consideration. We utilised 6.2% in this computation, which is based on a levered beta.

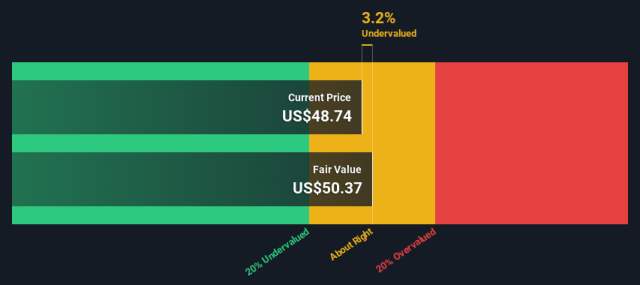

Although significant, the DCF computation shouldn’t be the only analysis you look at in relation to a business. A flawed technique for stock valuation is the DCF model. The optimum use of a DCF model is to evaluate hypotheses and assumptions to see if they result in an undervalued or overpriced organisation. The risk-free rate and the company’s cost of equity, for instance, might have a big influence on the valuation. We’ve outlined three crucial points about Tyson Foods that you should look into further: