The most influential shareholder groups in Schlumberger Limited (NYSE:SLB) should be known to all investors. Institutions own the largest percentage of the company’s shares—roughly 83%—of the total. In other words, if the stock increases, the group stands to gain the most (or lose the most, if there is a decline).

Institutional investors suffered the most losses as a result last week when the market value dropped by US$5.1 billion. This particular set of investors might not be pleased with the latest loss, which brings the total loss for the year to 1.0% for stockholders. Because they manage substantial financial resources, institutions, also known as “liquidity providers,” typically have a great deal of influence on changes in stock prices. Because of this, if the downward trend keeps up, institutions could feel under pressure to sell Schlumberger, which might be bad news for ordinary investors.

Because institutions report to their own investors primarily against a benchmark, inclusion in a large index tends to boost institutional enthusiasm for a given company. Most businesses should, in our opinion, have some institutions listed on the register, particularly if they are expanding.

As you can see, Schlumberger has a substantial level of institutional investor ownership. This may suggest that the business enjoys some level of reputation among the investing community. It is advisable to exercise caution when depending on the purported confirmation that comes with having institutional investors, though. They make mistakes occasionally as well. When two significant institutional investors attempt to sell out of a stock at the same time, the share price typically drops significantly.

The board will probably need to take institutional investors’ preferences into consideration because they own more than half of the issued shares. We see that hedge funds don’t own a sizable stake in Schlumberger. With a 9.0% ownership stake, The Vanguard Group, Inc. is the company’s largest stakeholder. The second and third largest shareholders are BlackRock, Inc. and State Street Global Advisors, Inc., with 7.5% and 5.9% of the outstanding shares, respectively.

Upon deeper inspection, our ownership numbers indicate that no one stakeholder holds a majority, with the top 21 shareholders together owning 51% of the company.

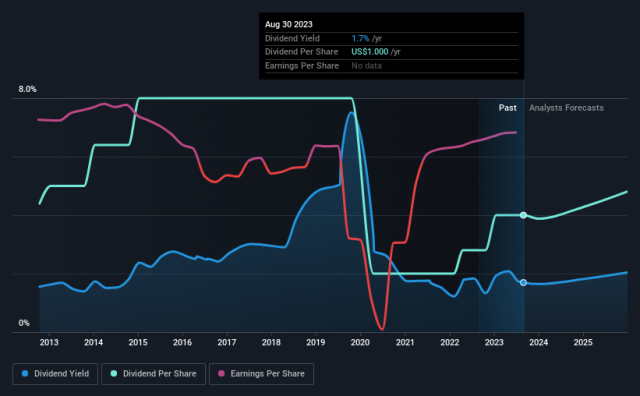

Researching a company’s institutional ownership can be valuable, but it’s also a good idea to look into analyst recommendations to have a better understanding of a stock’s predicted performance. Given the amount of analysts covering the stock, it might be helpful to learn about their collective outlook for the company.

Researching a company’s institutional ownership can be valuable, but it’s also a good idea to look into analyst recommendations to have a better understanding of a stock’s predicted performance. Given the amount of analysts covering the stock, it might be helpful to learn about their collective outlook for the company.