The most crucial group in the S&P 500 had a resurgence, which sent the gauge to a seven-week high. Many chartists view the US equities benchmark’s break above the 100-day moving average and its critical 4,400 level as positive developments. With Microsoft Corp. setting a record and Nvidia Corp. continuing its ascent into its ninth session, the Nasdaq 100 had its biggest rise since May.

“The stock market has made a significant comeback,” stated Adam Turnquist of LPL Financial. “The main drivers have been oversold conditions, strong earnings, and a sharp decline in interest rates.” “Reversing the S&P 500’s current downtrend and checking the box for a higher high—raising the probability that the correction lows were set last month” would be the outcome of a breakthrough above 4,400.

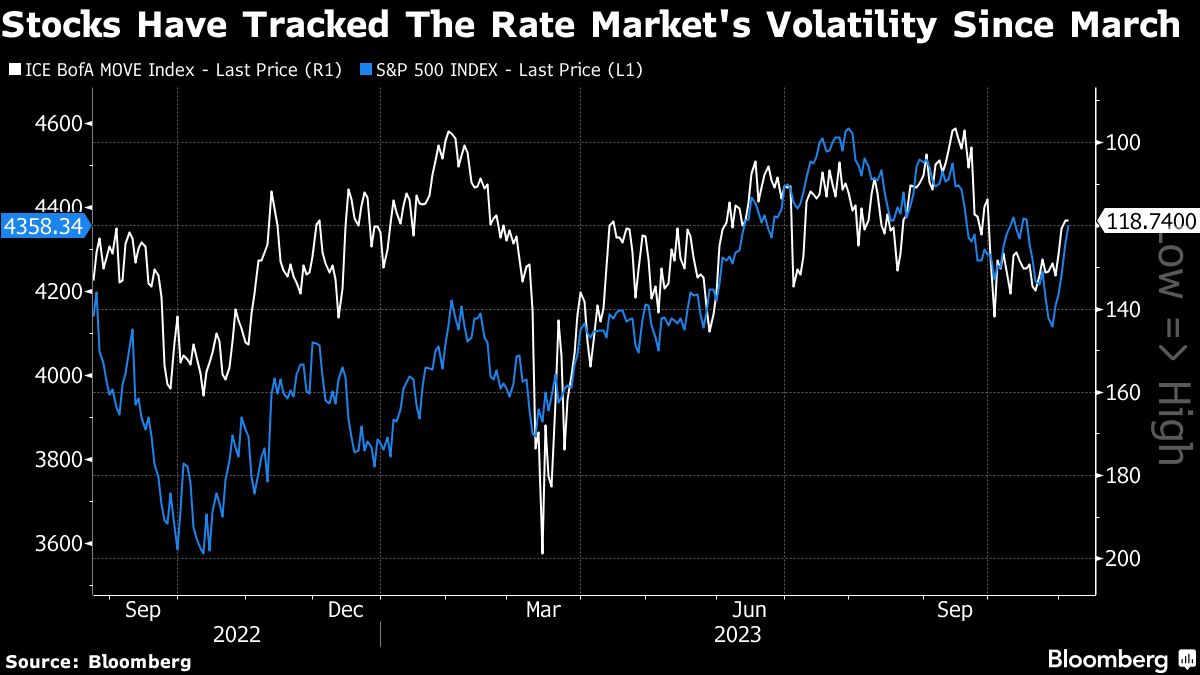

On Friday, stocks gained momentum due in part to a more tranquil day in the Treasury market. Following a spike in the previous session brought on by a lacklustre 30-year bond sale and Jerome Powell’s “sterner” tone on policy, ten-year rates saw no movement.

With Fed Bank of Atlanta President Raphael Bostic stating that policymakers can return inflation to their objective without having to rise further, Wall Street continues to watch the latest words from US authorities. His colleague Mary Daly in San Francisco stated that if inflation continues to climb while the economy is booming, the central bank could have to raise rates once again.

According to Jeffrey Roach, chief economist at LPL Financial, traders should anticipate the Fed emphasising its commitment to the 2% inflation objective. However, the rise in long-run inflation expectations suggests consumers are not persuaded the Fed can meet its inflation mission.

According to Mark Hackett, chief of investment research at Nationwide, “investors have softened their emotional reactions to data in recent weeks, with significantly less volatility, and we expect the same with the possibility of a government shutdown next week if a spending deal is not struck.”

He pointed out that historically, shutdowns have had a minimal impact on the economy and market.

According to Michael Hartnett of Bank of America Corp., the prudence that characterised the stock markets during the previous three months has given way to “year-end greed” due to anticipation of a drop in US bond yields.

Inflows of $8.8 billion were registered by global stocks in the week ending November 8, as per the notice that references data from EPFR Global. Cash is still the preferred asset type, according to Hartnett. Money market funds had inflows of about $77.7 billion throughout the course of the week, positioning them for record yearly inflows of $1.4 trillion.

“We see upside for equity indexes, driven by quality companies’ earnings growth,” UBS Global Wealth Management’s Solita Marcelli stated. “We think that investors who allocate their funds to well-balanced portfolios, with favourable expected returns across stocks, bonds, and alternative investments, should have a good year in 2024.”

According to Bank of America analysts Ralf Preusser and Meghan Swiber, investors who poured into long dollar positions in anticipation of a hawkish Fed are quickly exiting one of the most crowded bets this year.

They stated, “USD FX overweights have been drastically reduced, and the shift in sentiment has been the most noticeable since early 2021.”

In other news, the euro gained ground following the statement made by Christine Lagarde, President of the European Central Bank, saying policymakers will review hiking borrowing rates if necessary, but that maintaining the deposit rate at 4% should be sufficient to control inflation.

The price of bitcoin was close to $37,000, the highest level in 18 months. Oil developed,