The S&P 500 increased little on Monday following its best week of 2023, which was fueled by dovish Fed bets, oversold technical conditions, and positioning. Sentiment was affected by a reversal of bond market movements, with 10-year rates rising eight basis points to 4.65%. Treasury bonds declined in before of a slew of auctions starting on Tuesday and a busy schedule of corporate debt sales.

Read: S&P 500 Members See Significant Distortion Due to Winner-Take-All Rally

Additionally, Wall Street combed through the Senior Loan Officer Opinion Survey (SLOOS), which revealed that US banks continue to impose stricter rules and saw lower demand. Over the next few days, a number of Fed representatives, including Chair Jerome Powell, are scheduled to speak. Swaps are valued at greater than 100 basis points.

Andrew Brenner, head of international fixed-income at NatAlliance Securities, wrote, “The Fed is DONE, DONE, DONE.” “A rate cut in June is set in stone, but the markets are pricing in four rate cuts for next year. If nothing else, look for the Fed to back off on that as an optional measure. Powell intends to reclaim a portion of the financial constraints that have been eased.

According to Morgan Stanley’s Chris Larkin at E*Trade, the key to determining if the market momentum can be maintained is whether incoming economic data will continue to support the findings of last week’s employment report, which indicated a slowdown in the labour market in October.

Bulls could accept the notion that the Fed will become less hawkish if that cooling trend continues, according to Larkin. Whatever the case, following extraordinarily large movements such as the one that occurred last week, the market usually tends to retreat in the near term, at least momentarily.

Technical Testing

Chartists are keeping an eye on the 4,355 level, which represents a 50% retracement of the S&P 500’s peak-to-trough slide from its July highs to October lows. The S&P 500 is presently trading at 4,365.98. Keith Lerner, co-chief investment officer at Truist Advisory Services, says the next figure to watch is 4,400, where the index was hovering at its mid-October highs, if it remains above that level.

The S&P 500 still has to break over 4,400 in order to buck this downward trend, according to Lerner, whose company is overweight US equities.

Michael Wilson of Morgan Stanley claims that the S&P 500’s strongest week of the year was really a bear-market rally. “We find it difficult to get more excited about a year-end rally,” he continued, citing a bleak earnings forecast, poor economic data, and weakening analyst opinions.

In the meanwhile, Marko Kolanovic of JPMorgan Chase & Co. predicts that investors will soon find stocks unappealing once more due to the likelihood of persistently high interest rates and slowing growth returning to the forefront. Although dovish central bank meetings and declining bond rates were “knee-jerk positive for equities,” he pointed out that the growth-policy tradeoff will still be difficult to make through the rest of the year.

Chief market technician at ROTH MKM JC O’Hara stated, “The question we need to ask ourselves is whether the October breakdown was a ‘bear trap.'” If so, a quick ascent is to be anticipated. If not, we ought to consider reducing exposure to light at the moment.

Any year-end stock market rally, according to Jean Boivin of BlackRock Inc.’s research division, could not last long since markets don’t accurately represent the expectation that interest rates would stay higher for an extended period of time.

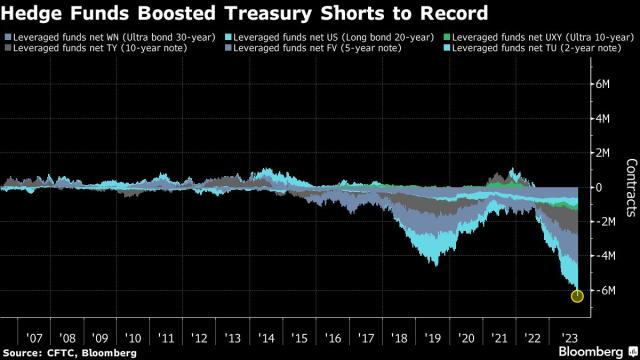

Since hitting a top of 5.02% on October 23, 10-year Treasury yields have fallen as traders for the $26 trillion bond market have returned to pricing in the conclusion of rate rises. A number of factors, including less hawkish signals from the Fed, weaker-than-expected jobs statistics, and more benign US refunding requirements, may have encouraged widespread covering of short positions.

According to a compilation of data from the Commodity Futures Trading Commission as of October 31, leveraged funds increased their net short holdings in Treasury futures to the highest level since 2006. The cash bonds had increased in value the previous week, but the bets remained.

The question of whether 10-year Treasury rates have truly peaked is the top concern among the equities investors that RBC Capital Markets met with last week, according to Lori Calvasina.

“Our belief over the past month or so has been that US equities could escape without suffering too much additional damage if the surge in yields stopped soon,” Calvasina continued. Seasonally speaking, November has usually been a strong month for the S&P 500.

After announcing sharp subscriber losses and third-quarter profitability significantly below Wall Street’s estimates, Dish Network Corp. plummeted to its lowest point in 25 years.

According to Reuters, Tesla Inc. is preparing to launch a new model at its manufacturing near Berlin that would retail for €25,000 ($26,863). This comes as competition to create more reasonably priced electric cars for the European market is heating up.

The biggest meat manufacturer in the US, Tyson Foods Inc., is recalling about 30,000 pounds (13 metric tonnes) of kid-friendly chicken nuggets because they may contain metal fragments.

The cash reserve of Berkshire Hathaway Inc. reached a new high of $157.2 billion, driven up by rising interest rates as well as a lack of significant transactions in which billionaire investor Warren Buffett might spend his capital.

Whitney Wolfe Herd, the CEO of Bumble Inc., has announced her resignation from the firm, which she created over ten years ago.

Gaining from increasing traffic, Europe’s largest low-cost airline, Ryanair Holdings Plc, intends to distribute around 25% of its yearly earnings to shareholders in addition to paying out a dividend of €400 million ($430 million).