If you’re a dividend aficionado who relies on dividend growth for your investment portfolio, you may find it interesting to learn that Starbucks Corporation (NASDAQ:SBUX) will go ex-dividend in just four days. The record date, which is the deadline for being listed as a shareholder on the company’s books in order to collect the dividend, is typically one business day prior to the ex-dividend date. Because it takes at least two business days for a stock transaction to settle when it is purchased or sold, the ex-dividend date is significant. Consequently, if you want to collect the dividend, which Starbucks will pay on November 24th, you might buy shares of the firm before November 9th.

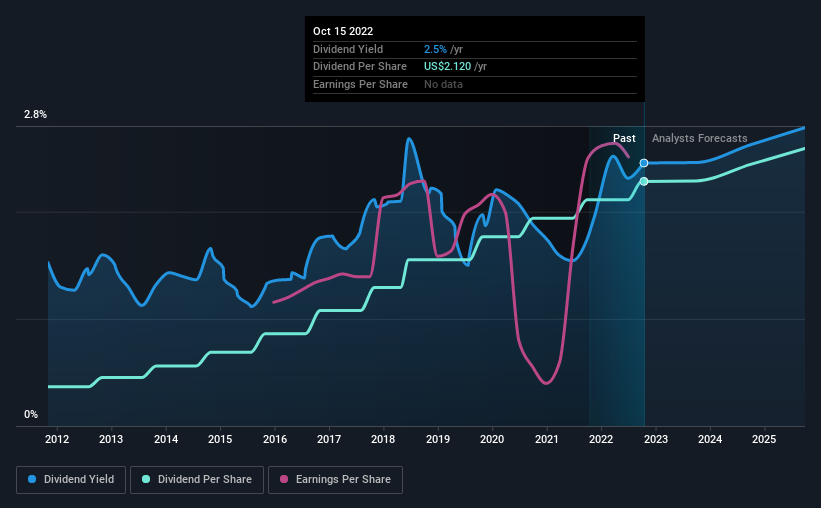

Following up on its distribution of US$2.28 per share to shareholders during the previous 12 months, the business is set to pay out a forthcoming dividend of US$0.57 per share. Based on its current stock price of $102.65, Starbucks has a trailing yield of around 2.2% when looking at the previous 12 months of payouts. Although we enjoy it when businesses give us a dividend, we also need to be sure that laying the golden eggs won’t kill the golden goose! Therefore, we must look at Starbucks’ ability to pay out its dividend and whether company has room to grow.

It’s not ideal for a firm to give out more dividends than it makes since that might make the payout unsustainable. Over half (60%) of Starbucks’ earnings were distributed to shareholders last year, which is a typical payout percentage for most businesses. However, even really prosperous businesses occasionally run the risk of not having enough cash on hand to pay dividends, so we should constantly make sure that cash flow can support the payout. 66% of the company’s free cash flow was allocated to dividends in the previous year, which is typical for the majority of dividend-paying companies.

The fact that profit and cash flow are sufficient to fund the dividend is positive. In general, this indicates that the payout is sustainable—as long as profits don’t decline sharply.

Since it is simpler to raise the dividend when profits are growing, stocks of firms that create consistent earnings growth frequently provide the highest dividend prospects. Should profits decline significantly, the business could have to reduce its dividend. For this reason, the news that Starbucks’ profits per share has increased by 2.0% annually over the last five years is encouraging. The corporation has not increased earnings per share, and the majority of its earnings are already being distributed to shareholders. Although there is some space for both raising the payout ratio and reinvesting in the firm, a company’s chances of expanding in the future are often diminished the higher the payout ratio.

A common way for investors to evaluate a company’s dividend performance is to look at how much the payments have fluctuated over time. Over the previous ten years, Starbucks has increased its dividend by an average of 18% annually. The company’s decision to raise dividends at a time when earnings are rising is positive and indicates that it at least somewhat values paying shareholders.

Buy Starbucks now or wait until the next dividend? The company’s earnings per share has not increased significantly, and even though it distributes the majority of its cash flow and earnings as dividends, these payments don’t seem out of the ordinary. As a whole, it’s difficult to find Starbucks very exciting from a dividend standpoint.