Tuesday saw gains in stocks notwithstanding a resurgence in the benchmark 10-year Treasury yield, as investors anticipated a deluge of earnings from large tech companies and other noteworthy businesses.

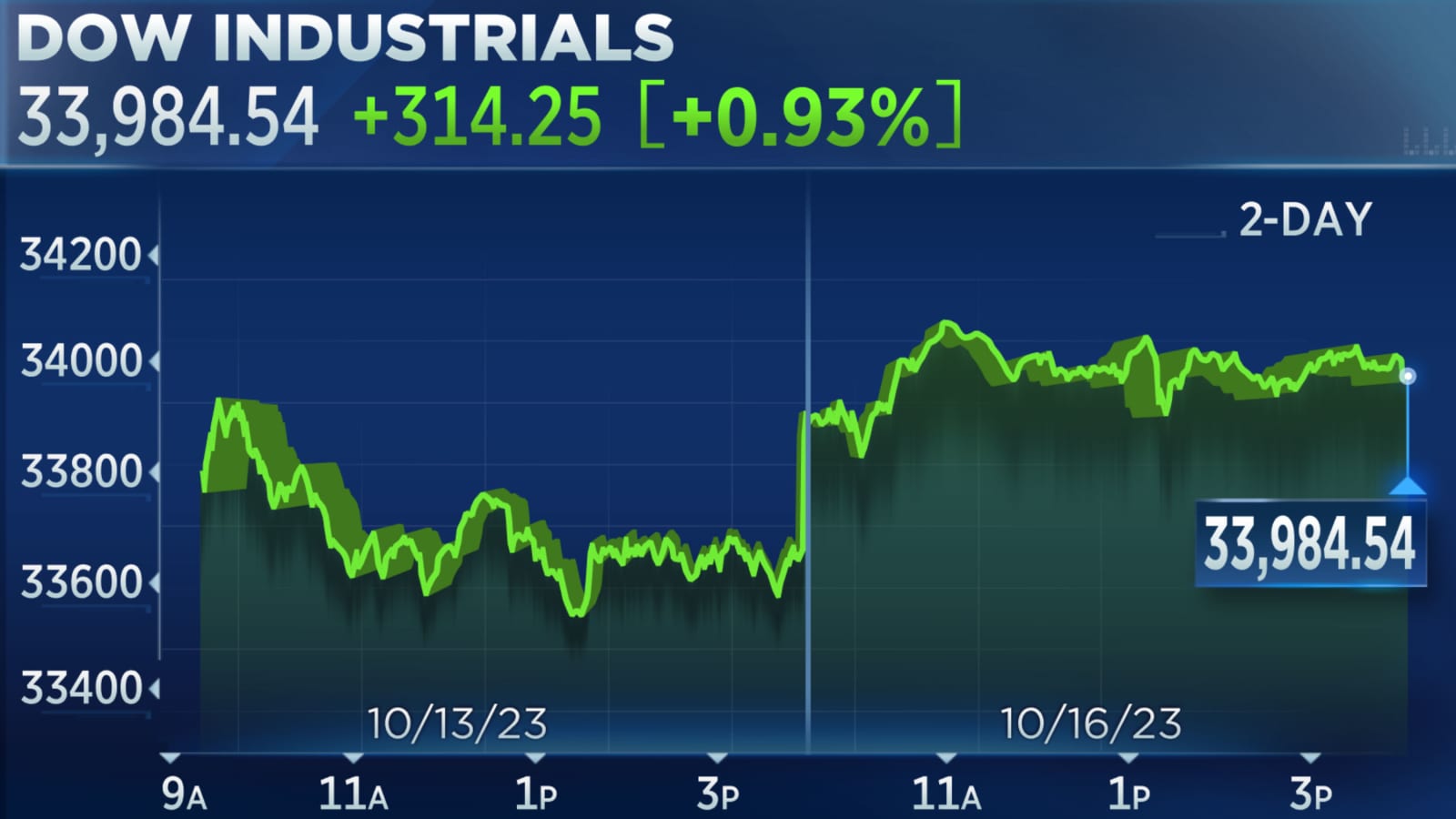

The Nasdaq Composite (^IXIC) surged over 1%, the S&P 500 (\GSPC) surged over 0.7%, and the Dow Jones Industrial Average (^DJI) jumped more than 0.6%.

Another indication of volatility, the 10-year yield (^TNX) edged up to 4.84% after falling earlier in the morning. The yield spiked above 5% on Monday, the highest since 2007, only to see a whipsaw descent.

Focus is firmly fixed on the deluge of high-profile earnings releases. Due to an increase in expenses associated with the UAW strikes, General Motors (GM) withdrew its profit projection for 2023 before to the bell.

On Tuesday afternoon, the stock of Verizon (VZ) topped the Yahoo Finance hot tickers page. The telecoms company’s shares increased by more than 8% after it increased its free cash flow projection for 2023 to $18 billion from $17 billion. In terms of quarterly sales and profits per share, it likewise exceeded Wall Street’s projections.

Tuesday afternoon saw a more than 7% increase in GE (GE) shares after the firm reported better-than-expected profitability and increased its forecast for 2023 full-year earnings per share.

After the business revealed higher-than-expected sales and earnings per share for the most recent quarter, Coca-Cola (KO) shares surged by more than 3%. Coke raised its full-year estimates for organic sales and profits per share.

Following the bell, Microsoft (MSFT), Alphabet (GOOG, GOOGL), and Snap (SNAP) are scheduled to release their earnings, with a major emphasis on any developments in the artificial intelligence space.

Following the bell for Microsoft and Google, Yahoo Finance tech writers Dan Howley and Allie Garfinkle have the data you need to know.

Microsoft: In the fourth quarter, the business announced yet another sequential fall in Azure growth. However, experts anticipate that in the new quarter, Microsoft will reverse that trend.

Based on statistics provided by Bloomberg, revenue for the quarter is anticipated to reach $54.5 billion, representing a roughly 9% year-over-year gain compared to Microsoft’s performance in the same quarter last year. Adjusted earnings per share (EPS) of $2.66 is what analysts are expecting, up from $2.35 in Q1 2023.

Google’s parent business Alphabet: On Tuesday, following the bell, the company released its third quarter earnings, providing Wall Street with its first comprehensive look at the state of the digital advertising industry for the period. Additionally, the research will offer new perspectives on whether Google’s cloud and corporate companies are benefiting financially from the company’s recent advances in AI.

The news is made when Google is defending itself against two antitrust lawsuits brought by the Department of Justice, which charge the business of abusing its influence and stifling competition in the internet search and digital advertising sectors.

For the third quarter, revenue (excluding of traffic acquisition expenditures) is anticipated to reach $63 billion, a 10% increase over the same period in the previous year, when the business earned $57.3 billion.

It looks like the much-discussed post-pandemic recession is finally here.

Since World War II, the inverted yield curve indicator, which appears when the yield on 3-month Treasury bills is higher than the yield on 10-year notes, has perfectly predicted every recession eight times out of nine.

However, the inversion itself hasn’t been the true flashing indication lately. Rather, it has occurred when the spread returns to normal and the inverted yield curve flips around. That came before the previous four recessions.

According to Campbell Harvey, the Canadian economist and Duke professor who invented the inverted yield curve indicator, “I’ve become a bit more pessimistic since August,” Harvey said with Yahoo Finance.

The issue with such course of action is that firms and consumers would subsequently be faced with the highest long-term interest rates in around sixteen years. This makes borrowing more expensive for regular folks looking to buy a house or a car. Additionally, it limits companies that depend on loans to stay in operation and may eventually impede the creation of new jobs if companies cease to develop.

“The long rate is much more important than the short rate because the longer rate is more aligned with business decisions, in terms of investment,” Harvey stated. “An investment is often not made for ninety days after it is made. This is a more sustained investment. Three, five, or even more years may pass.”

The industrial giant increased expectations and reported a quarterly earnings beat, citing growth in its aircraft division.

During the company’s results call, CEO Larry Culp stated, “GE Aerospace continues to experience rapid growth, driven by robust demand and solid execution, largely in commercial engines and services.”

The jet engine manufacturer raised its previous estimate of no more than $2.30 per share to $2.55 to $2.65 in 2023 adjusted earnings.

The industrial behemoth’s commercial engine deliveries are up 30% year to far despite challenges with the supply chain.