Wall Street’s major indexes fell on Friday as investors remained cautious due to the Middle East crisis and U.S. Treasury rates remaining close to multi-year highs after Federal Reserve Chair Jerome Powell’s hawkish comments.

Israel destroyed a neighbourhood in northern Gaza on Friday and attacked an Orthodox Christian church that served as a shelter for civilians while making it apparent that an order to invade Gaza was imminent.

Powell stated that stricter borrowing requirements may be necessary to contain inflation given the strength of the US economy and the country’s ongoing tight labour markets during his speech at the Economic Club of New York on Thursday.

It goes without saying that you would anticipate a slight retreat in the equities market when rates rise. Higher rates were a result of better-than-expected economic statistics, inflation not declining as predicted, and poor auction demand, according to Victoria Fernandez, chief market analyst at Crossmark Global Investments.

Although there was still too much inflation, Atlanta Fed President Raphael Bostic told CNBC that it was beginning to decline in light of growing signs of an economic downturn, which may pave the way for looser monetary policy later in 2019.

While reiterating that it was time to keep interest rates unchanged, Philadelphia Fed President Patrick Harker stated that the central bank must not allow inflation to pick up speed once more.

Prior to their meeting on November 1, Fed officials will go under a media blackout starting on Saturday.

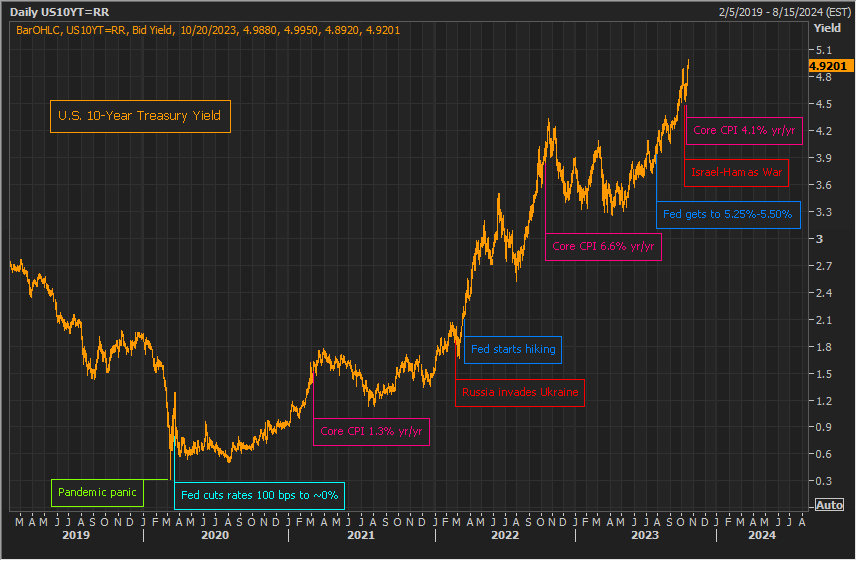

The yield on the 10-year Treasury note was last at 4.9073% on Thursday, after briefly exceeding 5% for the first time since July 2007.

As per CME’s FedWatch Tool, traders bet on a pause in December at a rate of about 74%, while they estimate a near 98% likelihood that the Fed will raise benchmark rates in November.

Mid-sized U.S. bank shares dropped following a series of quarterly reports that intensified market worries that the stimulus provided by the Federal Reserve’s interest rate rises to lenders was diminishing.

Regions Bank dropped 11.4%, hitting a low point not seen since March 2020.

American Express, a major credit card company, exceeded third-quarter earnings projections, but its stock dropped more than 4%.

At 11:46 a.m. ET, the S&P 500 was down 41.99 points, or 0.98%, at 4,236.01, the Nasdaq Composite was down 182.59 points, or 1.38%, at 13,003.59, and the Dow Jones Industrial Average was down 176.06 points, or 0.53%, at 33,238.11.

After taking into account the movements on Friday, all three indices were headed for weekly losses.

Among the major S&P 500 sectors, consumer discretionary, energy, and information technology led decreases, accounting for eight of the eleven sub-sectors that saw negative returns.

According to LSEG data, third-quarter profits for S&P 500 businesses are predicted to gain 1.1% year over year, down from a 1.6% increase that was projected on Thursday.

Following their warning of noticeably decreased sales in the fourth quarter, SolarEdge saw a 31.3% decline.

Following increased bitcoin prices, cryptocurrency and blockchain-related companies Coinbase Global, Riot Platforms, and Marathon Digital all saw increases of 2.3% to 2.7%.

On the NYSE and the Nasdaq, declining issues outnumbered advancers by a ratio of 2.17 to 1 and 2.07 to 1, respectively.

While the Nasdaq saw three new highs and 320 new lows, the S&P index saw no new 52-week highs and 32 new lows.