On Monday, the CSI 300 Index traded for the first time since September 28. It ended the day down 0.1%. Risk assets took a beating this week as a selloff in US Treasuries sent shockwaves through international markets due to resurgent worries about higher US interest rates lasting longer.

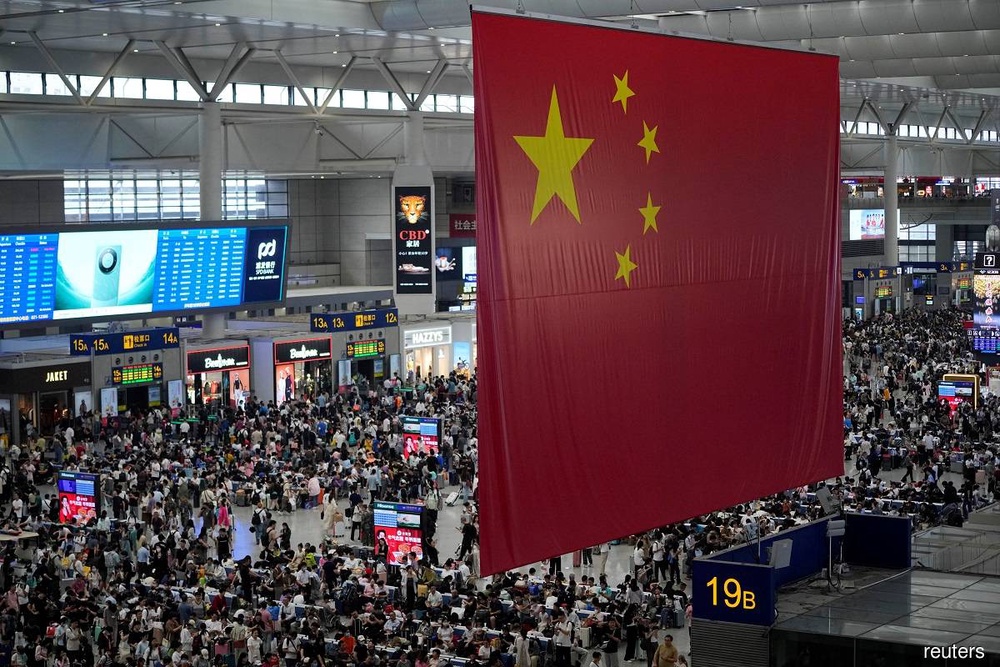

Despite a year-over-year increase to levels above pre-Covid, tourism earnings from China’s Golden Week holiday fell short of government projections, leading to the listless restart. Traders had been counting on an increase in consumption to support the market, which has been harmed by ongoing concerns over the real estate crisis.

According to Hao Hong, chief economist of Grow Investment Group, “the external environment has been quite confusing, so it’s kind of difficult to predict [the market] at this point. There are advantages and disadvantages, therefore a trader might find it challenging to trade the total index.

As mainland China markets resumed trading, offshore investors kept selling. The most overseas funds have sold domestic equities through trading linkages with Hong Kong on a net basis since September 25 was 7.5 billion yuan ($1 billion).

The decline in home sales over the holiday season from September’s levels highlights China’s inability to stop a record housing market slump that has stunted economic development and put pressure on the second-largest stock market in the world.

The housing market is still anticipated to have an L-shaped rebound in the upcoming years, according to Goldman Sachs Group Inc. analysts, even if China is likely to introduce additional relaxing measures in the next few quarters.

As Hong Kong trading reopened in the afternoon, a Bloomberg Intelligence indicator of Chinese developers fell as much as 3.5%. Due to a typhoon, the market’s morning session was postponed.

A broader measure of Chinese equities listed in Hong Kong, the Hang Seng, increased 0.4% on Monday, helped by advances in energy-related stocks as a result of the uptick in oil prices. During the time that mainland markets were closed, it had decreased by 0.3%.

With the CSI 300 Index down 4.8% for the year and less than 5% away from wiping out all of its gains from the reopening surge that began in October 2022, overall pessimism about Chinese markets remains pervasive.

Stocks in industries such as travel and leisure fell on Monday as a result of some traders’ disappointment with the holiday statistics. While UTour Group Co. slumped more than 9%, Air China Ltd. and China Southern Airlines Co. both had declines of at least 1.6%.

According to Willer Chen, senior research analyst at Forsyth Barr Asia Ltd., the violence in Israel and a little miss in holiday spending estimates are two factors that are weighing down Chinese shares.