Every investor is aware that not all swings land in the sweet spot. However, you should avoid at all costs any extremely large losses. Therefore, spare a thought for JCY International Berhad’s (KLSE:JCY) long-term owners; the share price has fallen by a staggering 76% over the past three years. That would undoubtedly undermine our faith in our choice to purchase the shares. It’s down 10.0% in roughly a month, which is far worse and not at all enjoyable.

So let’s take a look to see if the company’s longer-term performance has been consistent with the development of the underlying business.

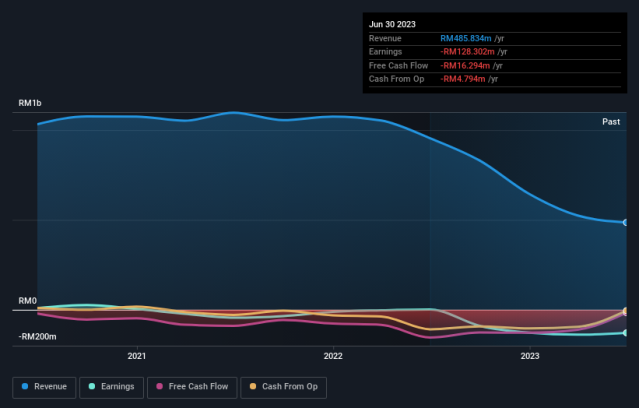

Due to JCY International Berhad’s lack of profitability during the past 12 months, it is doubtful that the share price and earnings per share (EPS) would exhibit a high link. Revenue is possibly our second-best choice. Investors in unprofitable businesses typically anticipate rapid revenue growth. This is due to the fact that it is difficult to predict if a business will survive if its sales growth is minimal and it never turns a profit.

JCY International Berhad has seen a 21% annual decline in revenue over the past three years. The majority of pre-profit enterprises tend to publish results that are weaker than that. As you might anticipate, the share price has also been weak, falling at a rate of 21% annually. We would prefer to leave attempts to catch falling blades, like this stock, to clowns. There is a reason why buying stocks that are rapidly declining in price is frequently referred to by investors as “trying to catch a falling knife.” Consider this.

The graph below displays the evolution of earnings and revenue over time.

It’s definitely important to note that the CEO receives less pay than the median for businesses of a similar size. Although it is always necessary to look into CEO compensation, the actual concern is if the company can continue to increase earnings in the future.

It’s encouraging to note that over the past year, JCY International Berhad shareholders have received a total shareholder return of 33%. These recent gains are without a doubt far better than the TSR loss of 5% annually over a five-year period. We are a little apprehensive as a result, although the company may have changed its course. Although it is necessary to take into account the various effects that market conditions may have on the share price, there are other aspects that are even more crucial.

Our articles are not meant to be financial advice; instead, we only offer analysis based on objective methods, historical data, and analyst forecasts. It doesn’t represent an advice to buy or sell any stock, and it doesn’t take into consideration your goals or financial position. We hope to provide you with long-term analysis that is driven by essential facts. Be aware that recent price-sensitive company announcements or high-quality information may not be taken into account in our analysis. No stock mentioned has any positions held by Simply Wall St.