The first fifteen years of my career were more about consolidation. Moving manufacturing to Mexico or Asia or to Eastern Europe,” Cutillo said in an interview. “It is truly the first time in my life I’ve seen stuff coming back.”

American firms’ mentions of nearshoring, reshoring and onshoring — synonyms for moving manufacturing back or closer to a company’s home country — grew by an average of 216% year over year since the start of 2022, data compiled by Bloomberg showed. That’s as private companies announced $516 billion of investments since President Joe Biden took office, according to White House figures last updated September 26.

That $500 billion represents more of an intensification of a trend that began gaining momentum under the Trump administration than it does a spark. “The trade war [with China] was the first big shock,” said Bloomberg Senior Geo-Economics Analyst Gerard DiPippo in an interview.

However, it was the pandemic that made the vulnerability of the globalised supply chain explicit, motivating businesses to seriously accelerate their nearshoring plans. The risks of relying on cheap production in Latin America and Asia were highlighted by backlogged ports and high-profile shipping blockages in the vital Suez and Panama canals, while technological advancements in automation and rising freight costs have made it more profitable to move production back to the US.

This signals a golden age for the unheard-of businesses constructing all the new factories, data centres, and warehouses, like Sterling Infrastructure, whose market value increased by 506% over the previous four years, from $390 million to $2.4 billion. In that time, the massive construction company Quanta Services Inc. nearly quadrupled to a $25 billion valuation, while rivals TopBuild Corp., Emcor Group Inc., and Fluor Corp. had gains of over 100%.

Construction connected to nearshoring is in demand from a variety of sectors, including the life sciences, healthcare, and technology. According to Sterling’s Cutillo, advances in artificial intelligence have increased demand for data centres, resulting in 20% to 30% sales increases in recent years. According to him, “We don’t see any slowdown happening in data centre” developments.

Along with American businesses, foreign businesses are promoting US manufacturing. Both the California-based Rivian Automotive Inc. and the South Korean Hyundai Motor Co. are constructing 1,100-acre electric vehicle facilities in Georgia with assistance from Sterling.

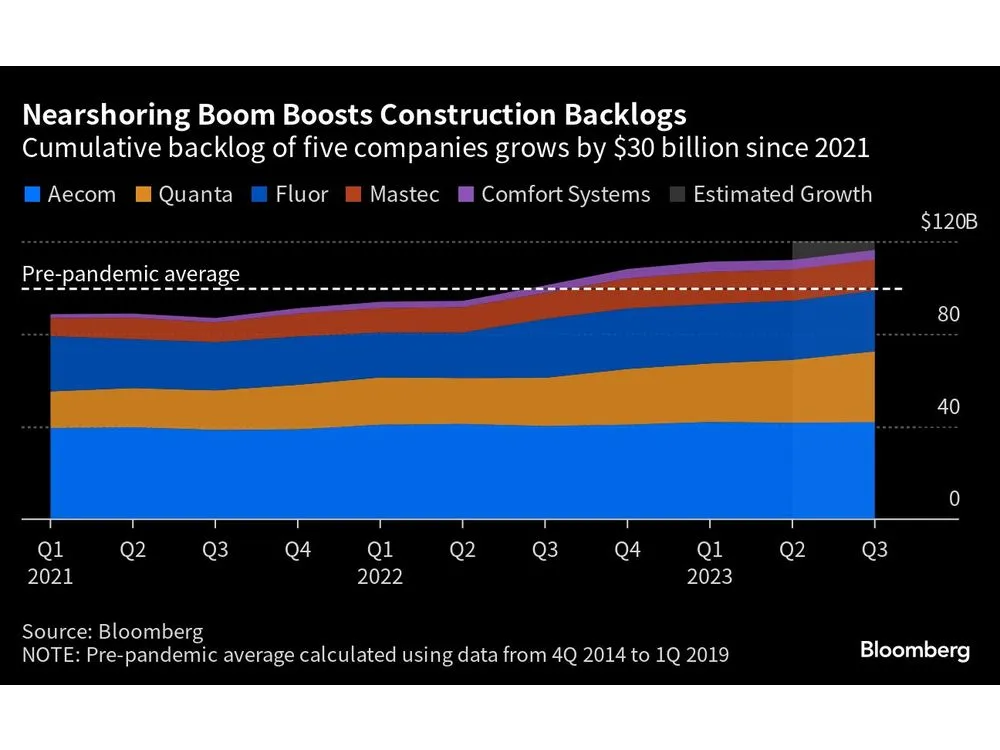

As a result, there are currently lengthy and expanding waiting lists at many construction companies. Nearly $120 billion is the combined backlog of Quanta, Fluor, and three of its competitors, which is about $20 billion more than the pre-pandemic average. And in the third quarter, that is anticipated to have increased by around 4% sequentially.

The amount spent on manufacturing and construction combined was $198 billion on an annualised basis in August, an increase of about 66% from the previous year and the greatest amount recorded since the Bureau of Economic Analysts started keeping track of the statistics in the 1950s.

A large portion of the recent spending boom can be attributed to two laws that the Biden administration successfully pushed through Congress and which offer billions in subsidies, tax credits, and other incentives to promote local manufacturing of semiconductors and electric vehicles, two geopolitically significant sectors in which China has made significant progress in recent years.

Continue reading: Huawei’s Surprising Comeback Ushers in New Phase of Tech Cold War

However, Congress cannot claim sole credit. Tony Guzzi, CEO of Emcor, stated in an interview that “these trends were happening with or without government stimulus.” “The government stimulus prolongs or solidifies demand,”

And while further billions have been allocated in a third bill for connecting the newly built plants with supported infrastructure like highways and airports, Cutillo asserts that more is still required: “We’re nowhere near the levels you really need to spend on the infrastructure,” he added.

As long as US-China relations are tight, nearshoring will undoubtedly gain in popularity. President Biden has permitted the Trump administration’s tariffs on Chinese imports to remain in place, despite comments made by US Commerce Secretary Gina Raimondo in August that the nation is becoming “uninvestible because it’s become too risky.” According to statistics gathered, China dropped to America’s third largest trading partner last year, behind Mexico and Canada, for the first time since 2004.

At the Asia-Pacific Economic Cooperation conference next month, Presidents Biden and Xi Jinping may interact for the first time in about a year as the two superpowers attempt to mend relations that have been shaken by nearshoring.