Li Lu, an external fund manager who is supported by Charlie Munger of Berkshire Hathaway, states unequivocally that the biggest investment risk is not price volatility but rather the possibility of experiencing a permanent loss of cash. Given that debt is frequently involved when a firm fails, it only makes sense to take into account a company’s balance sheet when determining how hazardous it is. Debt is evidently used in Thermo Fisher Scientific Inc.’s (NYSE:TMO) operations. However, the more crucial query is this: how much danger is that debt producing?

When a company finds itself unable to readily meet its obligations through free cash flow or by obtaining capital at a favourable price, debt and other liabilities become dangerous for the company. Investors may end up with nothing if the corporation is unable to meet its legal duties to pay back loans. Indebted corporations frequently permanently dilution shareholders because lenders force them to borrow capital at a distressed price, even if that is not very usual. Debt can, of course, be a useful tool for organisations, especially those with high capital requirements. When analysing a company’s usage of debt, we start by combining cash and debt.

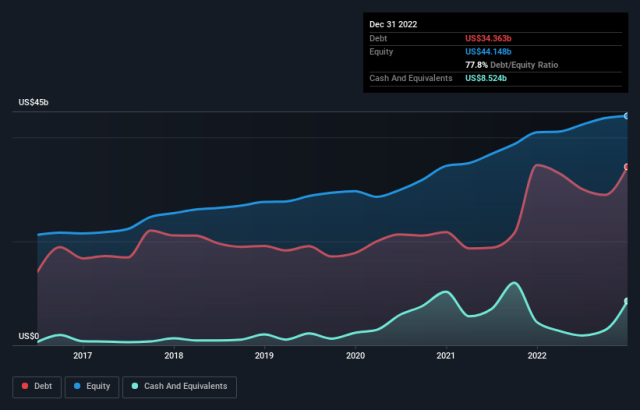

For historical data, please click the graphic below. As of July 2023, Thermo Fisher Scientific owed US$33.8 billion, a rise from US$30.1 billion over the previous year. Although it has a cash reserve of $3.13 billion, its net debt is less, at around $30.7 billion.

Zooming in on the most recent balance sheet information, we can see that Thermo Fisher Scientific had obligations totaling US$14.1 billion that were due within the next year and US$36.1 billion that were due after that. On the other hand, it had US$3.13 billion in cash and US$9.49 billion in receivables that were due within a year. Therefore, its liabilities are US$37.6 billion higher than its cash and short-term receivables put together.

It’s difficult to assume these liabilities pose much of a danger given Thermo Fisher Scientific’s enormous market capitalization of US$196.8b. Having said that, it is obvious that we should keep an eye on its balance sheet in case things worsen.

We examine a firm’s net debt divided by its profits before interest, taxes, depreciation, and amortisation (EBITDA) as well as how readily its earnings before interest and taxes (EBIT) cover its interest expense (interest cover) to determine how much debt a company has in relation to its ability to pay it off. This method has the advantage that it considers both the total amount of debt (with the net debt to EBITDA ratio) and the actual interest costs incurred by that debt (with the interest cover ratio).

Thermo Fisher Scientific has a debt to EBITDA ratio of 2.9, which indicates substantial debt but is still within most types of businesses’ acceptable ranges. The debt’s interest expense is now quite low, however, as evidenced by the very high interest coverage of 14.4. Investors need to be aware that Thermo Fisher Scientific’s EBIT decreased by 27% in 2017. Debt repayment will be more difficult if this trend keeps up than selling foie gras at a vegan convention. When assessing debt, it is obvious where to concentrate your attention: the balance sheet. But whether Thermo Fisher Scientific can gradually strengthen its balance sheet will ultimately depend on how profitable the company’s future operations are. Therefore, if you want to see what experts have to say,

This free study on analyst profit estimates might be of interest to you.

However, our final point is also crucial since a business cannot pay off debt with paper profits; it needs actual cash. Therefore, we always assess the amount of that EBIT that is converted into free cash flow. Given that free cash flow doesn’t include interest or taxes, Thermo Fisher Scientific’s free cash flow over the most recent three years was 73% of its EBIT, which is around average. When necessary, the corporation can reduce its debt thanks to this free cash flow.

Given its EBIT growth rate, Thermo Fisher Scientific is not having it easy, but the other aspects we took into account give us reason to be positive. We are very impressed with its intriguing cover. We are a little hesitant about Thermo Fisher Scientific’s usage of debt after taking into account all the aforementioned issues. While we recognise that debt can raise returns on equity, we would advise shareholders to closely monitor its debt levels in case they rise. The balance sheet is the logical place to start when examining debt levels. However, far from being the case, the balance sheet does not include all investment risk.