Following another round of dismal economic statistics from the euro area and China, European markets fell, and the euro fell to its lowest level versus the dollar in almost three months.

For the sixth day in a row, the Stoxx 600 declined up to 0.8%, while US equities futures also declined. The dollar rose as much as 0.5% against its peers in the Group of 10 and reached its highest point since March. Following a US vacation on Monday, US Treasury yields increased.

According to an industry study, China’s services sector experienced the slowest growth in August of this year, which adds to the evidence that the economic recovery is stalling and dims earlier optimism on government assistance. The composite purchasing managers’ index in Europe fell short of forecasts and showed a decline for a third consecutive month.

Survey results that indicate the economy is entering a recession raise serious concerns for the euro-area situation, according to Sarah Hewin, head of Europe and Americas research at Standard Chartered. It makes the ECB’s future ability to be forceful in question.

Next week is the European Central Bank’s interest rate meeting.

The poor Chinese PMI numbers had a significant impact on European stock sectors that were exposed to the No. 2 economy in the world, with brands like LVMH, Kering, and Adidas falling more than 2%.

The figures subdued the upbeat mood created on Monday by reports of brisk new-home sales over the weekend in two important Chinese cities, which seemed to indicate that the government’s stimulus measures were working. The MSCI Asia Pacific Index was on track for its first decline in seven days earlier in the day, and the offshore traded yuan also declined.

Country Garden Holdings Co. reported that it paid coupons on two dollar bonds within the grace periods, which is a rare instance of good news. It’s been reported that the distressed developer who has come to represent China’s real estate problems wants to postpone principal payments on eight yuan bonds.

Hewin of Standard Chartered anticipates additional actions from Beijing to increase loan growth. There have been several supportive initiatives, and in our opinion, there is still room for significant rate decreases on the budgetary side.

The Australian currency took a hit from the Chinese statistics as well, falling as much as 0.7% against the US dollar. The Australian dollar, which was already the worst-performing developed market currency this quarter, suffered from indications that the central bank won’t raise interest rates any further. On Tuesday, the bank did as was predicted: nothing.

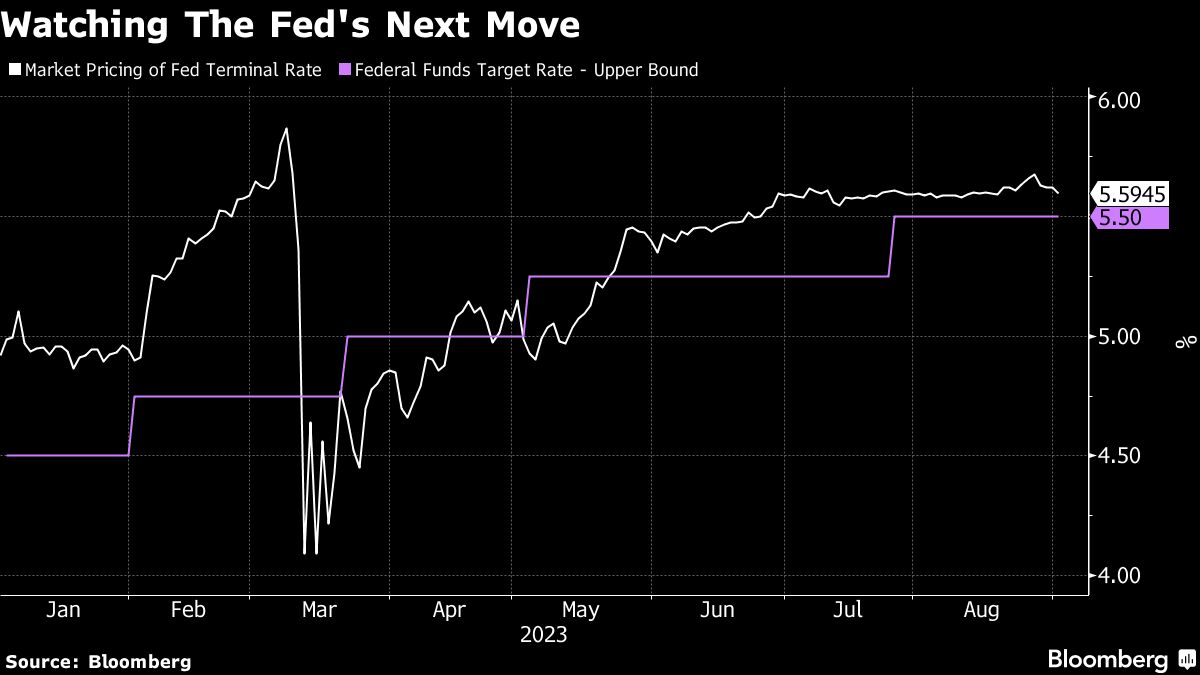

The problems overseas helped the US dollar. Even though many economists believe the Federal Reserve has finished its 18-month campaign of tightening policy, a relatively strong economy suggests interest-rate reduction may not happen anytime soon. A US recession is now only expected to happen 15% of the time, according to Goldman Sachs Group Inc., down from their earlier prediction of 20%.

The market has been dragged to defending the dollar, according to Roberto Cobo Garcia, head of G10 FX strategy at Banco Bilbao Vizcaya Argentaria SA. “The disappointing PMI data out in China and Europe so far have dragged the market to backing the dollar,” he said. After the US holiday yesterday, higher Treasury yields are also supporting the advance.

Away from those recent nine-month highs, Brent crude fell for the first time in six days, falling 0.9% to $88.22 a barrel on anticipations of further production curbs from the OPEC+ producers’ group.