From $656 million, or 26 cents per share, a year earlier, net income increased to $6.19 billion, or $2.48 per share.

Strong sales and a positive outlook for Nvidia highlight how essential the company’s graphics processing units (GPUs) have become to the rise of generative AI. Building and running artificial intelligence (AI) applications like OpenAI’s ChatGPT and other services that accept simple text inquiries and respond with conversational answers or visuals require Nvidia’s A100 and H100 AI chips.

The second quarter’s revenue doubled from $6.7 billion a year earlier and rose 88% over the first.

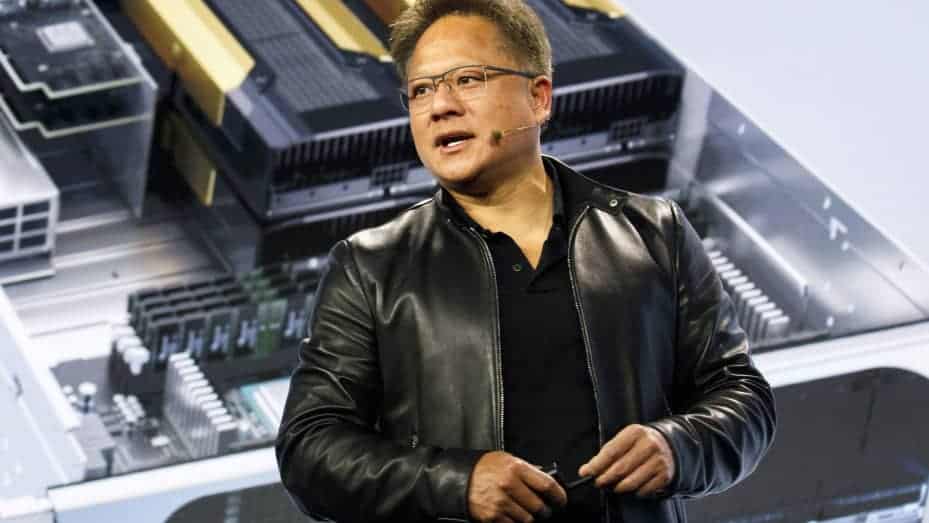

On a conference call with analysts, Nvidia CEO Jensen Huang stated that “the world has something along the lines of about a trillion dollars worth of data centres installed, in the cloud, enterprise, and otherwise.” Data centres worth a trillion dollars are in the midst of switching to accelerated computing and generative AI.

The company would not be immediately impacted by proposed Biden administration chip export curbs, according to finance head Colette Kress on the results call.

We don’t expect any export restrictions on our data centre GPUs, if adopted, to have an immediate meaningful impact on our financial results, Kress added, citing the robust global demand for our products.

Nvidia’s stock price had more than tripled for the year even before Wednesday’s release, making it the best performer in the S&P 500. After hours, it increased to about $500, which would be a record high if it closed at that level on Thursday. On July 18, it reached a closing high of $474.94.

As next-generation processors were scooped up by cloud service providers and major consumer internet giants like Alphabet, Amazon, and Meta, Nvidia’s performance was driven by its data centre business, which also includes AI chips. According to StreetAccount, the company recorded group revenue of $10.32 billion, above the $8.03 billion projection by 171% year over year.

Nvidia further stated that due to a rise in sales of lucrative data centres, its adjusted gross margin increased 25.3 percentage points to 71.2%.

Previously the major business of Nvidia, the gaming sector saw revenue rise 22% year over year to $2.49 billion, exceeding the $2.38 billion average projection.

Additionally, Nvidia produces CPUs for advanced graphics applications. To $379 million, that company saw a 24% year-over-year decline. Automotive revenue for the company was $253 million, up 15% from the prior year.

After buying $3.28 billion worth of shares during the quarter, Nvidia announced that its board of directors had approved a $25 billion share repurchase programme.