For the first time in nine months, Germany’s 10-year yield went below 2% following news that producer prices had declined more than anticipated in November. Amid concerns that the region is headed for a recession, the Stoxx Europe 600 index gave up its early gain and is currently trading roughly 0.2% lower.

The statistics revealed that inflation dropped more than analysts had predicted in November, supporting the argument for a Bank of England pivot to rate cuts next year. As a result, the UK’s benchmark FTSE 100 excelled, jumping as much as 1.3%. A three-week low was reached by the pound, while the yield on 10-year gilts fell by as much as 11 basis points.

Traders are placing bets that the European Central Bank will begin reducing rates in 2019 in response to decelerating inflation and sluggish economic growth. By March of next year, the money markets are pricing in nearly a 50% possibility of an ECB rate cut.

Surprisingly, a measure of German business forecasts released earlier this week

declined for a seventh month in December as conditions in

additionally been cutting losses on longer-term US bond wagers as investors retreat from the desire to oppose the dovish turnabout.

Thomas Barkin, the president of the Richmond Federal Reserve, maintained the more dovish stance by implying that interest rates will be lowered by the US central bank provided recent inflation gains persisted. Nonetheless, other officials have resisted rate cut wagers with greater vigour. President of the Chicago Fed Austan Goolsbee and the

Loretta Mester of the Cleveland Fed said on Monday that the anticipations were unrealistic.

Investors are awaiting US data readouts on Wednesday, Thursday’s third-quarter GDP print, and Friday’s orders for durable goods and PCEs (the Fed’s measure of personal consumption expenditures).

To solidify their bets on interest rates, investors are awaiting data readouts from the US, such as Wednesday’s existing home sales, Thursday’s third-quarter GDP print, and Friday’s durable goods orders and personal consumption expenditures (PCEs), the Fed’s favourite indicator of inflation.

Amidst this, the yield on Japan’s benchmark government bond dropped to its lowest level since the Bank of Japan modified yield curve control towards the end of July. In the interim, the Nikkei 225

The stock gauge reached its highest point in over five months following the central bank’s failure to inform investors when policy changes may be made. For the first time in four days, the yen appreciated.

“We’re off to a sweet start thanks to a softer USD, softer European yields, and a sweet Wall Street rally overnight,” said Vishnu Varathan, Asia head of economics and strategy at Mizuho Bank Ltd. in Singapore. “A softer yen following the BOJ’s reversal, which boosted the Nikkei, was also a welcome treat for Asian equity bulls capping off US rallies.”

In the business sector, Eddie Wu, the Chief Executive Officer of Alibaba Group Holding Ltd., will assume responsibility for the company’s primary e-commerce division, taking over from one of its most seasoned leaders as the head of China’s largest online marketplace.

Following two days of gains, oil saw little movement as shippers and traders prepared for the possibility of further disruption in the Red Sea. Gold held stable as well.

Wednesday’s US Conference Board consumer confidence and existing-home sales

Thursday’s rate decision from Bank Indonesia

Thursday: US GDP, first-ever unemployment claims, Conference Board leading index

Nike’s quarterly results, Thursday

Japan’s inflation on Friday

Friday’s UK GDP

US consumer spending and income, sales of new homes, durable goods, Friday’s consumer sentiment index from the University of Michigan

Among the principal market movements are:

the euro-area PMIs grew worse. According to a Bloomberg survey of analysts, the region will experience its first recession.

following the pandemic. Concurrently, the rate of inflation in the eurozone is declining, with a peak of 2.4% in November compared to above 10% in the previous year.

Following another record high for the Nasaq 100, US market futures declined. The yield on the Treasury 10-year fell five basis points to 3.89%.

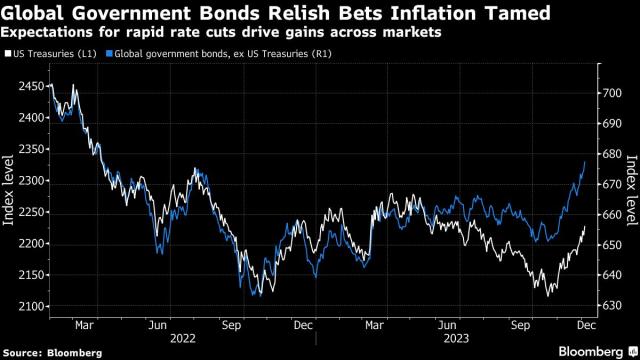

According to a Bank of America Corp. poll released on Tuesday, market optimism is at its highest level since the start of 2022 due to speculation of Fed easing. Dealers possess

According to a Bank of America Corp. poll released on Tuesday, market optimism is at its highest level since the start of 2022 due to speculation of Fed easing. Dealers possess